[ad_1]

Ethereum’s (ETH) Shanghai and Capella — Shapella — updates elevated investor confidence, which led to $17 million value of inflows into ETH-based funding merchandise throughout the week of April 17-23, in response to CoinShares’ weekly report.

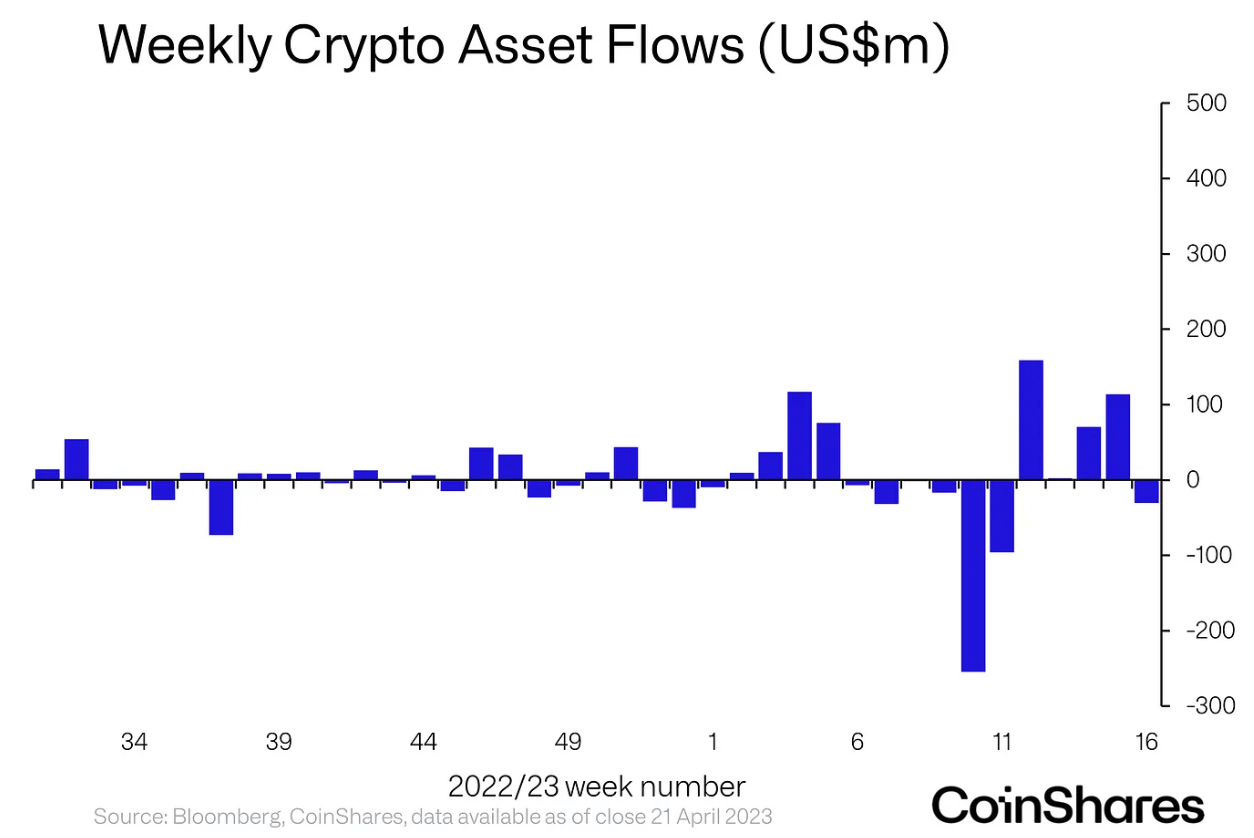

Though ETH-based merchandise flourished, the general crypto funding instruments market recorded a $30 million loss throughout the earlier week, because the CoinShares report acknowledged.

The losses recorded on the week of April 17 have been the primary hostile motion in 5 weeks. The report famous that the outflows began to extend throughout the week earlier than, on April 14 — which was across the time when Bitcoin (BTC) surpassed the $30,000 worth mark.

ETH’s Shapella improve additionally coincided throughout the identical week — pushing the traders in the direction of betting on BTC throughout the week of April 10. Contemplating that the outflows began to surge throughout the center of the week means that the sell-off was doubtless the results of traders who wished to scoop earnings.

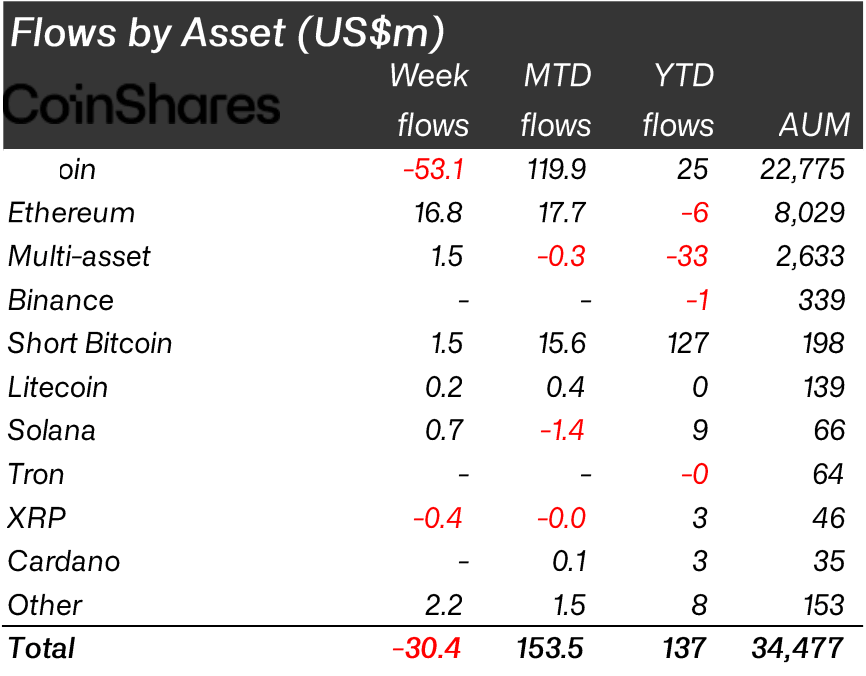

Flows by asset

The outflows emerged on April 14 and continued throughout the week of April 17. Nonetheless, because the report outlined, the profit-taking was solely restricted to BTC — which recorded $53.1 million in outflows.

Ripple (XRP) was the one different asset contributing to the outflows by shedding $400,000 throughout the week.

ETH led the property that contributed to inflows by accumulating $16.8 million. Quick-BTC merchandise, Litecoin (LITE) and Solana (SOL), additionally recorded inflows value $1.5 million, $200,000, and $700,000, respectively.

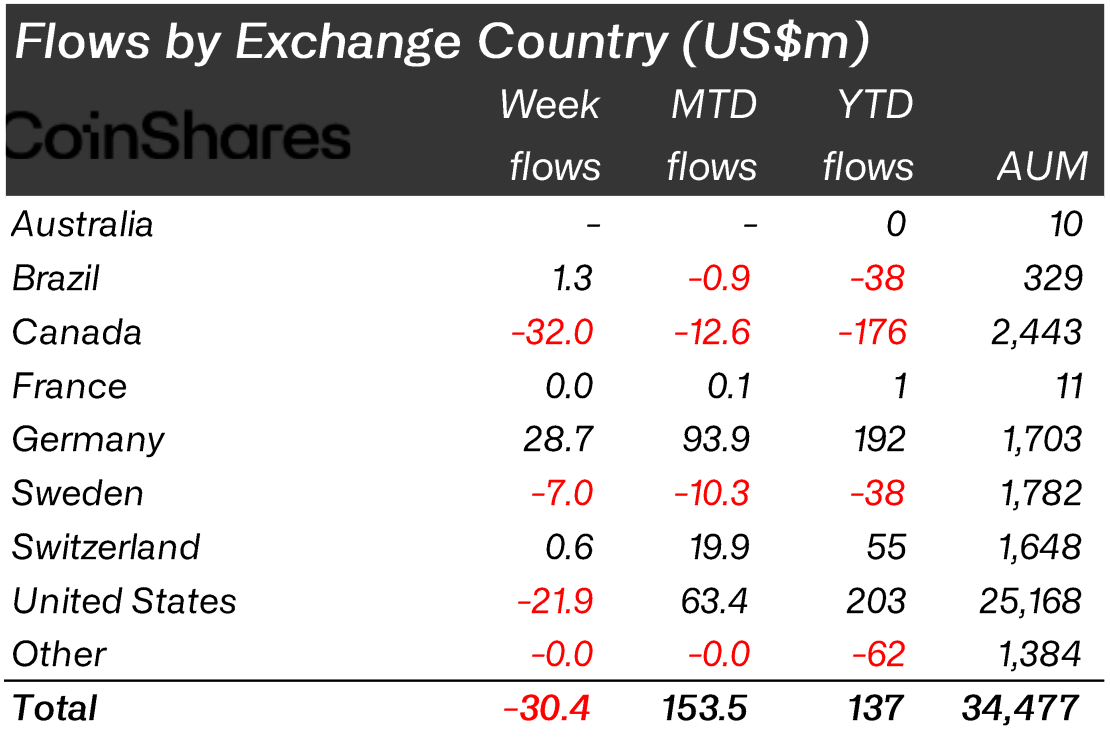

Flows by nation

Regionally, North America led the BTC sell-offs. Canada recorded $32 million in outflows — whereas the U.S. recorded one other $21.9 million. Sweden additionally contributed one other $7 million to flows as effectively.

In the meantime, Germany emerged because the main nation in inflows by including $28.7 million to the market. Brazil and Switzerland additionally recorded inflows — value $1.3 million and $600,000, respectively.

Categorizing the flows by suppliers, ProShares emerged as the principle supplier that recorded the very best quantity of outflows value $23.4 million. 3iQ and CoinShares XBT recorded one other $20.9 million and $7 million in outflows.

CoinShares Bodily noticed $15.7 million in inflows, bringing the combination to $8.7 million in inflows for CoinShares. 21 Shares and Objective additionally recorded $2.3 million and $900,000 in inflows, respectively.

[ad_2]

Source link