[ad_1]

With yesterday’s stoop in Bitcoin and crypto markets, the uncertainty returns. Bitcoin, because the lead forex of the crypto market, is presently struggling to regain assist at $29,100.

At press time, Bitcoin has not but been in a position to initialize an uptrend. BTC was buying and selling at $28,680, down -5.5% because the value was rejected on the $30,500 stage on Tuesday. Nearly all of altcoins are following this development, writing even greater losses for probably the most half.

Purchase The Bitcoin And Crypto Dip?

The co-founders of on-chain knowledge supplier Glassnode, Jan Happel and Yann Allemann write of their newest market replace “don’t get spooked” and clarify {that a} $900+ transfer in Bitcoin is according to expectations, “keep away from shake outs”.

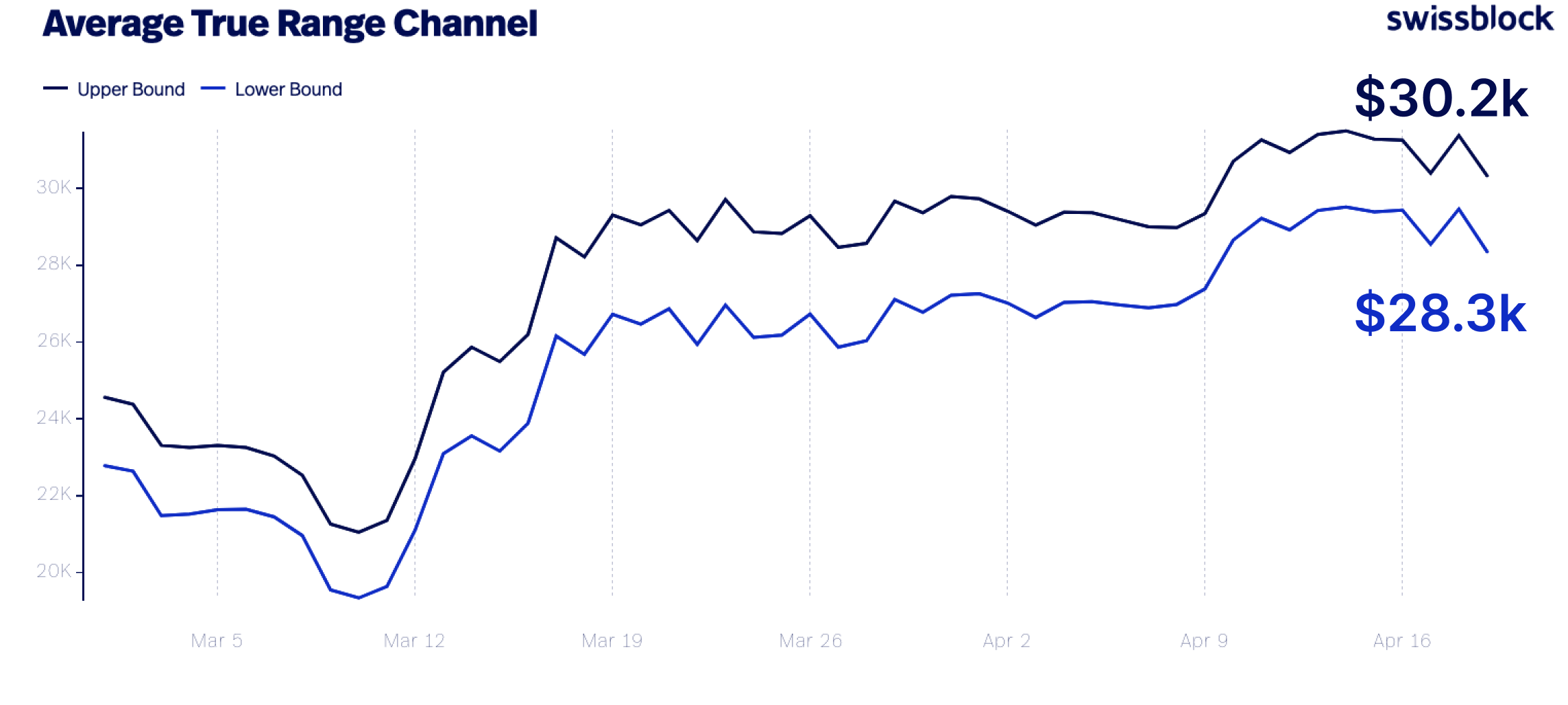

In keeping with the analysts, the market sentiment stays intact. Each the worry and greed index and the on-chain knowledge (NUPL) proceed to look bullish. Bitcoin’s common true vary is between $28,300 and $30,200, based on Glassnode founders.

Sentiment has not turned damaging both. The worry and greed index continues to sign greed out there, which must be thought-about bullish. Moreover, the 2 analysts comment:

As we speak’s retrace to the decrease finish of $29k is an efficient alternative to purchase. Our mid-term outlook stays bullish, order books present extra liquidity, and the Bitcoin Danger Sign is at 0.

Internet Unrealized Revenue and Loss (NUPL), the distinction between market cap and realized cap divided by market cap, signifies that unrealized good points exceed unrealized losses, which can also be bullish.

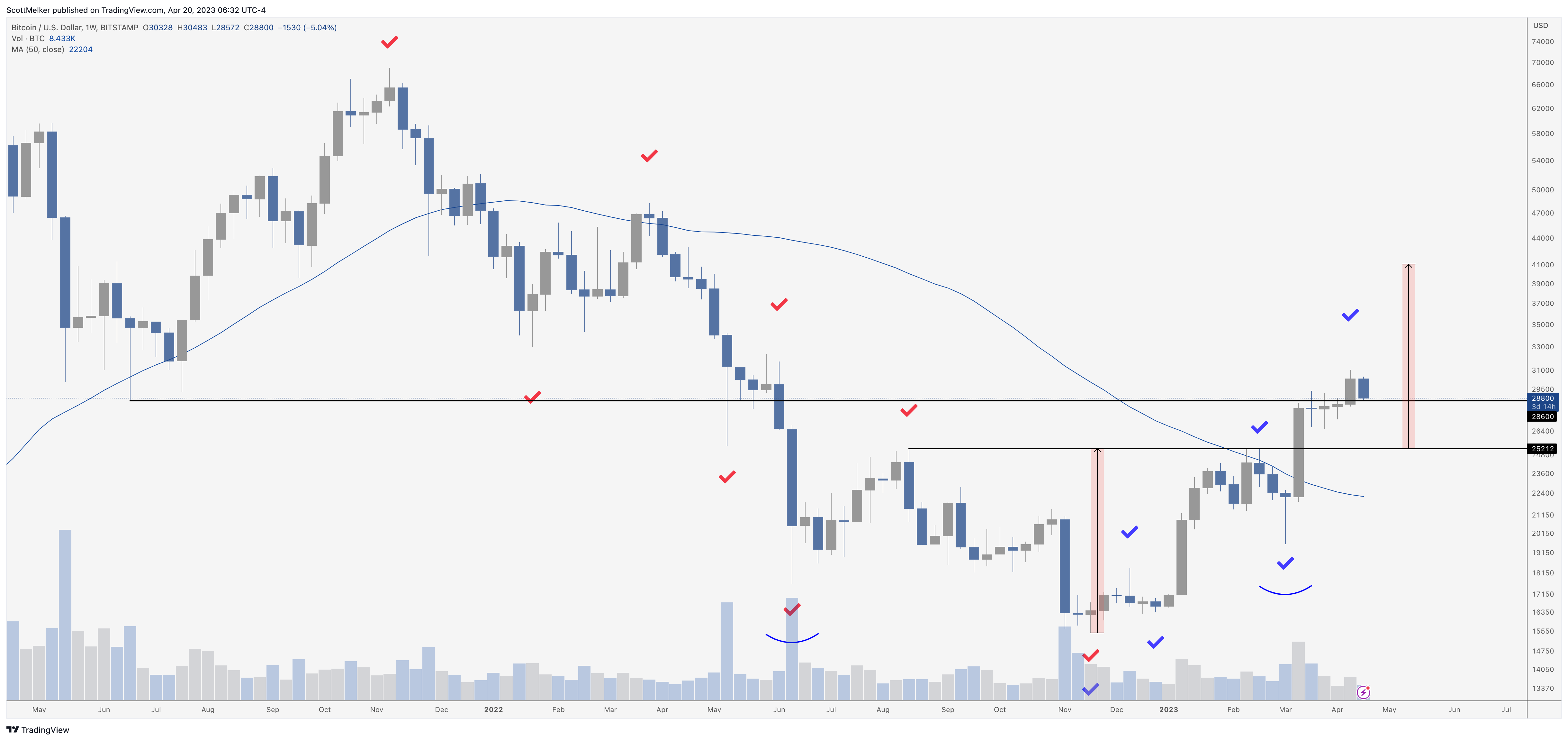

Analyst Scott Melker thinks it stays to be seen whether or not this correction will proceed. Nonetheless, he’s assured that Bitcoin has discovered some assist on the “most predictable stage” at $28,600:

I’ve been screaming this quantity from the mountaintop, so there must be no shock right here. […] That is theoretically robust assist. If it breaks, we glance to $25,212. Play it stage by stage.

The famend dealer @52kskew, referring to the 4-hour chart of Bitcoin, notes that there’s a retest of the earlier resistance. In his opinion, a weak RSI divergence and the stochastic RSI sign that there will probably be a aid bounce.

A bullish state of affairs, based on him, could be a reclaim of $29,500 and the 4-hour/ 1-day trendline. The bearish state of affairs is a rejection at $29,500 and the 1-day EMA development, in addition to a development in the direction of $27,000.

Relating to the decrease timeframe mixture CVDs and delta of Bitcoin, he notes, “Value shifting larger right here; whereas CVDs shifting decrease = restrict shopping for & some absorption of sellers under $28.6K. Market shopping for but to observe (which is the market momentum required for larger costs).”

The Binance Open curiosity is also an indicator that BTC will see a aid bounce:

Some excessive quick float right here & funding shifting decrease. Ideally for a aid bounce there’s continued spot shopping for & funding goes damaging later.

At press time, the Bitcoin value stood at $28,680, bouncing up from one other leg down.

Featured picture from iStock, chart from TradingView.com

[ad_2]

Source link