[ad_1]

Shanghai, Capella, Shapella, 0x01, execution layer, consensus layer – whereas the web3 group undoubtedly boasts spectacular technical competence, Ethereum’s newest replace had even the most effective of us confused at instances.

A Nansen report on Ethereum withdrawals reviewed by CryptoSlate shone a light-weight on all the things that’s occurring, utilizing knowledge derived from Nansen’s Shapella dashboard.

Sha-nghai Ca-pella

The Shapella Improve, efficiently executed on April 13, marked a big milestone in Ethereum’s multi-stage roadmap by enabling the withdrawal of staked Ethereum (ETH) on the Beacon chain. This extremely anticipated improve reduces the liquidity threat related to staking, encouraging elevated participation.

The identify comes from combining the 2 simultaneous upgrades, Shanghai and Capella. Shanghai upgraded the execution layer, and Capella upgraded the consensus layer. The upgrades differed solely by way of the a part of the community they focused, because the aim of each upgrades was to open withdrawals.

Ethereum staking

In contrast to different Proof-of-Stake (PoS) programs, Ethereum requires validators to stake a hard and fast quantity of 32 ETH, with rewards based mostly on this quantity. Validators might have greater than 32 ETH as a result of accrued rewards or much less if slashed or penalized. To allow withdrawals, validators should set their withdrawal credential prefixes from 0x00 to 0x01.

For the reason that Shapella improve, the variety of validators with the 0x01 credential has elevated from 40% to 83.3%, in keeping with Nansen’s knowledge.

Moreover, Ethereum’s staking system entails two forms of withdrawals: partial and full.

Partial withdrawals embody withdrawing accrued rewards whereas retaining the minimal 32 ETH required for validator operation, processed periodically by way of an automatic course of in roughly 2-5 days.

Furthermore, full withdrawals contain withdrawing a validator’s whole steadiness voluntarily or following a slashing occasion. Full withdrawals take longer than partial withdrawals, involving a number of steps: the exit queue, a “minimal validator withdrawability” delay of 256 epochs (27.3 hours), and the automated withdrawal course of (2-5 days).

Why do stakers have to attend in a queue?

The exit queue serves as a protecting measure to keep up the safety of the Ethereum community. Its major perform is to regulate the speed at which validators can exit the community, stopping a lot of them from leaving concurrently. If too many validators exited rapidly, the community might grow to be weak to assaults as a result of a lowered variety of lively validators securing it.

The 27.3-hour delay (equal to 256 epochs) imposed on the exit course of is an extra safety measure designed to offer the community with ample time to detect and reply to any dangerous actions. This delay acts as a safeguard, guaranteeing that dangerous actors can’t negatively affect the community after which exit with out consequence. Basically, the exit queue and the related withdrawal delay work collectively to keep up the soundness and safety of the Ethereum community throughout the validator exit course of.

Liquid staking

Liquid Staking By-product protocols (LSDs), equivalent to Lido, ship capital effectivity by leveraging liquidity and, thus, might affect validator selections. There was a slight enhance within the quantity of ETH staked in LSDs because the Shanghai improve. Though no dashboard presently tracks if this enhance is primarily pushed by restaking, a correlation is probably going as a result of advantages of LSDs. Nansen is reportedly engaged on a dashboard to trace this metric.

Understanding upcoming withdrawals is crucial for assessing Ethereum’s staking ecosystem. Kraken, one of many high withdrawers, is usually misconceived as one of many high sellers. Nevertheless, in keeping with the report, their “full exits haven’t materially impacted whole withdrawal numbers,” as most withdrawals have been rewards and validators are nonetheless within the exit queue or pending the automated withdrawal course of. Moreover, validators might produce other causes to request withdrawals, equivalent to switching validator setups or transferring to LSD protocols.

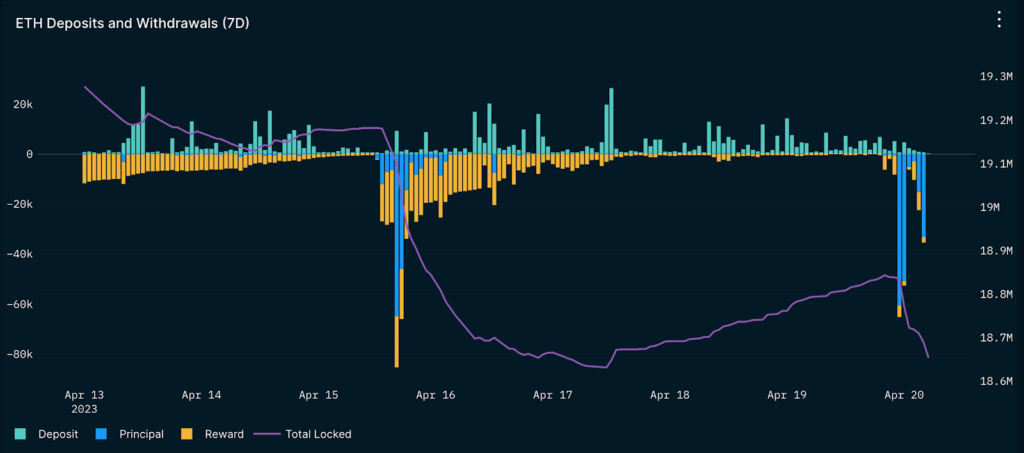

Nansen’s knowledge on deposits vs. withdrawals gives useful insights into the circulation of ETH between locked and unlocked states, with the cumulative sum used to estimate modifications within the liquid provide of ETH.

Nansen knowledge analyst Martin Lee commented,

“Whereas the chart offers an excellent overview of the change in liquid provide, it lacks nuance when making inferences on the implications of the withdrawals. With the intention to achieve correct insights into the withdrawal knowledge, realizing the break up between partial and full withdrawals is important.”

Insights on Shapella

Lee’s speculation on Shapella suggests there shall be a rise in participation and the general quantity of ETH staked within the community now that Ethereum withdrawals are stay. In that case, it might deliver Ethereum’s staking ratio nearer in keeping with different main L1s.

The speculation relies on the commentary that Ethereum had one of many lowest staking ratios amongst main L1s and was the one chain with out withdrawals enabled till the Shanghai improve. Because the improve approached, there was a fast enhance within the quantity of ETH staked, indicating a robust curiosity in staking ETH.

Nevertheless, Lee additionally highlighted Ethereum’s staking ratio may not attain as excessive as another chains, primarily as a result of giant NFT ecosystem and the rising DeFi ecosystem. The assorted use circumstances for ETH set it aside from different main L1 tokens, which might affect its staking ratio. Lee believes you will need to take into account that the introduction of withdrawals might not essentially result in mass promoting stress, as many elements can affect the choices of validators and customers

Lee in the end argued that the next occasions have had individuals “leaping to conclusions too early.’

Kraken unlocks = mass promoting stress

The general pattern within the quantity of staked ETH based mostly on present withdrawal knowledge

Kraken being pressured to unwind their staking service within the US doesn’t essentially imply they (or their clients) are promoting. It simply means they must exit as validators. What customers do with the ETH is but to be seen.

The quantity withdrawn now shall be extremely risky, with spikes right here and there based mostly on partial and full exits. It’s solely been 4 days, and a baseline has not but been established.

In conclusion, the Shapella improve has unlocked new potentialities for Ethereum staking and introduced extra flexibility to validators. Understanding the nuances between partial and full withdrawals, the affect of LSDs, and key metrics like deposits vs. withdrawals will assist crypto lovers navigate this new panorama.

The submit All the pieces you could learn about ETH Shapella withdrawals appeared first on CryptoSlate.

[ad_2]

Source link