[ad_1]

New knowledge from crypto insights agency Messari reveals the Cardano (ADA) ecosystem’s fast enlargement over the past 12 months.

In a brand new report, Messari says that Cardano’s complete worth locked (TVL), or the quantity of property sitting inside its protocols, has gone up 172% quarter over quarter (QoQ).

In keeping with Messari, the latest launch of Cardano-stablecoins have been the principle drivers behind the expansion.

“Whole worth locked (TVL) denominated in USD on Cardano grew 172% QoQ from $50.8 million to $138.3 million. The latest adoption of recent stablecoins was a catalyst for this progress, as they’re a cornerstone of DeFi however have been lacking from the ecosystem.”

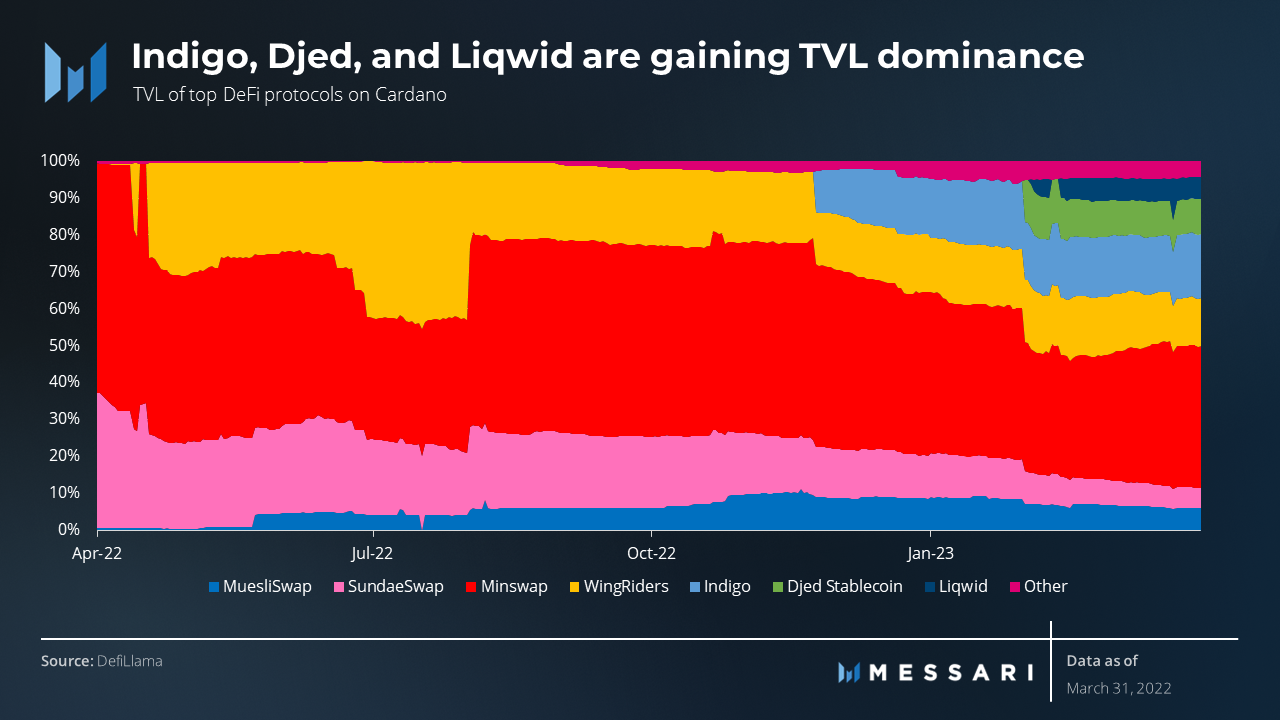

Messari says that Minswap, an automatic market maker (AMM) on Cardano, stays the chain’s main decentralized change (DEX) so far as TVL, however decreased in dominance over the primary quarter as a result of emergence of a number of DeFi (decentralized finance) protocols, together with ADA-backed stablecoin Djed.

“The shift in dominance from incumbent DEXs to rising DeFi functions is because of:

Djed, an overcollateralized ADA-backed stablecoin minting protocol, ending Q1 with a TVL of $13.1 million and a dominance of 9.5%.

Liqwid, a borrowing and lending protocol, ending Q1 with a TVL of $8.4 million and a dominance of 6%.

Indigo, an issuer of artificial property and stablecoins, ending Q1 with a TVL of $24.1 million and a dominance of 17.4%.”

Messari says that in Q1 of this 12 months, Cardano noticed important progress in technological developments resembling developments in scalability and VM (digital machine) compatibility.

Final week, Cardano builders Enter Output International introduced the launch of Lace, a brand new Cardano-native crypto pockets that helps {hardware} pockets integration and entry to NFT (non-fungible token) marketplaces, decentralized apps (DApps) and DeFi providers. Customers can even stake ADA straight from the platform.

The builders say they’re already engaged on new options that will likely be added to future releases as they promise to provide Lace a slew of standard updates and enhancements.

“The Lace group is already onerous at work growing a DApp Retailer, a desktop app and digital identification options. In the meantime, fiat on/off ramps, in-wallet swaps, a richer staking expertise with multi-delegation, and a portfolio view are all within the pipeline.”

Do not Miss a Beat – Subscribe to get crypto e-mail alerts delivered on to your inbox

Test Worth Motion

Observe us on Twitter, Fb and Telegram

Surf The Day by day Hodl Combine

Test Newest Information Headlines

Disclaimer: Opinions expressed at The Day by day Hodl are usually not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any loses chances are you’ll incur are your accountability. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please notice that The Day by day Hodl participates in internet affiliate marketing.

Featured Picture: Shutterstock/VectorBar/Mingirov Yuriy

[ad_2]

Source link