[ad_1]

Based on Brazil’s president Luiz Inácio Lula da Silva, creating international locations ought to abandon the U.S. greenback and strengthen their very own nationwide currencies. Throughout a speech on the New Growth Financial institution in Shanghai, Lula expressed his nightly pondering: “Why do all international locations need to base their commerce on the greenback?”

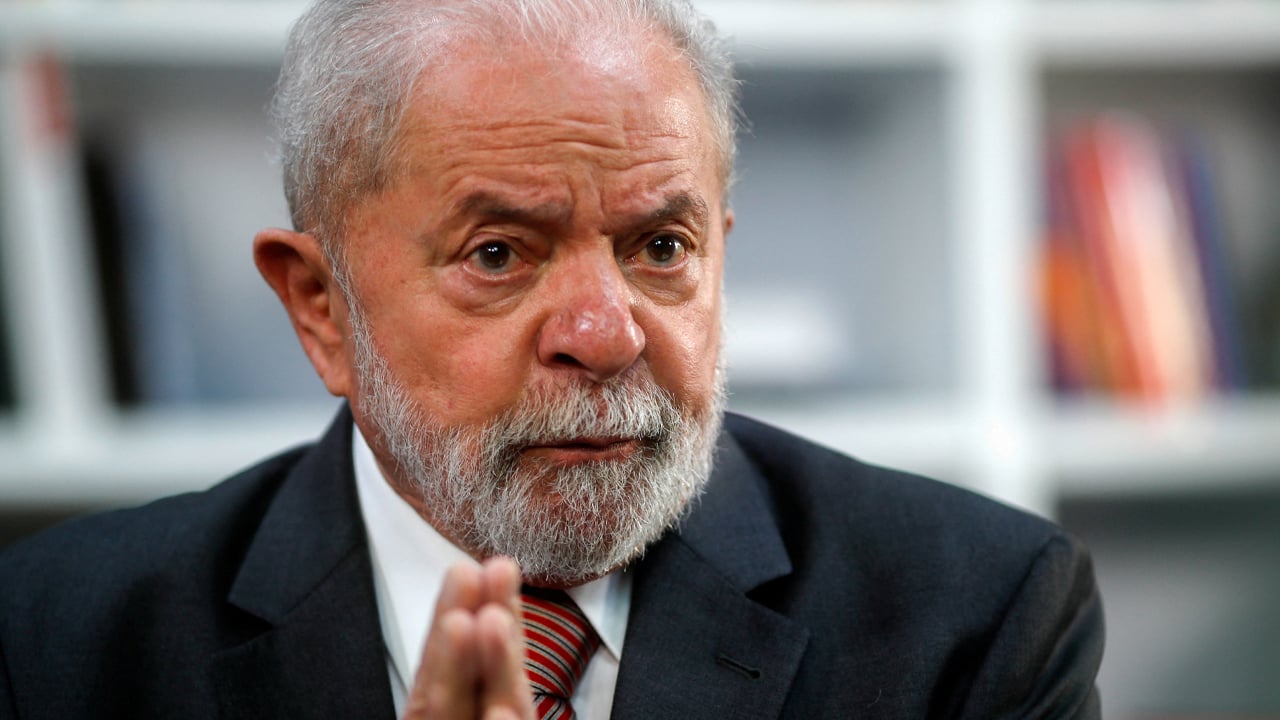

Brazil’s President Desires to Scale back the U.S. Greenback’s World Dominance

Current discussions have targeted on eradicating the U.S. greenback’s standing as the worldwide reserve forex, and this concept is changing into extra of a actuality in 2023. Talking on the New Growth Financial institution in Shanghai, often known as the ‘BRICS Financial institution,’ President Lula insisted that the buck’s international dominance ought to finish, as reported by the Monetary Instances.

“Who determined that our currencies had been weak or worthless in different international locations?” Lula questioned throughout his speech. “Why can’t a financial institution like that of the BRICS have a forex to finance commerce relations between Brazil and China or Brazil and different international locations? It’s tough as a result of we’re unaccustomed [to the thought]. Everybody will depend on only one forex,” he added.

Lula’s statements come after China signed a brand new take care of Brazil and accomplished its first Liquefied Pure Fuel (LNG) fee in yuan. Russia has additionally been dedicated to settling trades utilizing different international locations’ currencies. Furthermore, BRICS members (Brazil, Russia, India, China, and South Africa) are working in direction of creating a brand new BRICS-based reserve forex. In Shanghai, Lula voiced his curiosity concerning the world’s dependence on the buck.

“I ask myself each evening why all international locations need to base their commerce on the greenback,” Lula emphasised. “Why can’t we commerce utilizing our personal currencies? Who determined that the greenback could be the dominant forex after the gold customary disappeared?” he inquired.

Monetary Instances reporters Joe Leahy and Hudson Lockett concluded their report on Lula’s statements by noting that any efforts to undermine the U.S. forex “within the close to time period will face a considerable problem.” They highlighted that Brazilian miners commonly have interaction in dollar-denominated trades. Nonetheless, officers from Brazil and the BRICS nations will not be alone in discussing the potential decline of the greenback’s dominance.

The Philippines’ central financial institution governor, Felipe Medalla, just lately talked about in an interview that the buck’s prominence will step by step diminish. “We would like a multi-currency world, however up to now, different currencies wouldn’t have the mandatory worldwide markets to assist [it]. That is the benefit of the U.S. greenback – there’s an unlimited marketplace for authorities securities,” Medalla said. “I believe over time, the greenback will probably be much less and fewer dominant, however it’s taking place very slowly,” he added.

Do you assume a shift away from the U.S. greenback as the worldwide reserve forex is inevitable, and what affect do you consider this may have on the worldwide financial system and monetary programs? Share your ideas about this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any harm or loss brought about or alleged to be attributable to or in reference to using or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link