[ad_1]

The Ethereum Shanghai improve is about to go surfing later right this moment. Right here’s what influence it might have available on the market, in keeping with Glassnode.

How Will Ethereum Shanghai Improve Influence The Market?

Final September, Eethereum efficiently transitioned to a proof-of-stake (PoS) consensus mechanism, that means that stakers changed miners as validators on the community. To turn out to be a staker, a person has to lock 32 ETH right into a deposit contract.

Whereas the mainnet solely transitioned final yr, this staking contract has been in place since November 2020, earlier functioning as a part of the PoS take a look at community. Anybody that has been locking cash into this contract, nevertheless, has been unable to withdraw them to date, as solely deposits have been allowed.

This may lastly change with the “Shanghai improve,” which is an ETH onerous fork that may give buyers the power to withdraw their cash from the Ethereum staking contract.

Now, there are of course considerations across the market as to how the sudden unlock of those cash might influence the ETH financial system. In its newest weekly report, the on-chain analytics agency Glassnode has damaged down the doable situations that will comply with after the ETH Shanghai improve goes stay later right this moment.

Shanghai will enable two sorts of withdrawals to buyers: partial and full. The previous kind refers to automated withdrawals of the staking rewards the validators have collected, whereas the latter one entails an entire exit of the quantity locked in by the staker.

Whereas the customers haven’t been in a position to withdraw their cash to date, they’ve nonetheless been in a position to signal a voluntary exit message prematurely. After the onerous fork goes stay, the community will scan all of the validators to see who has signed these exit messages.

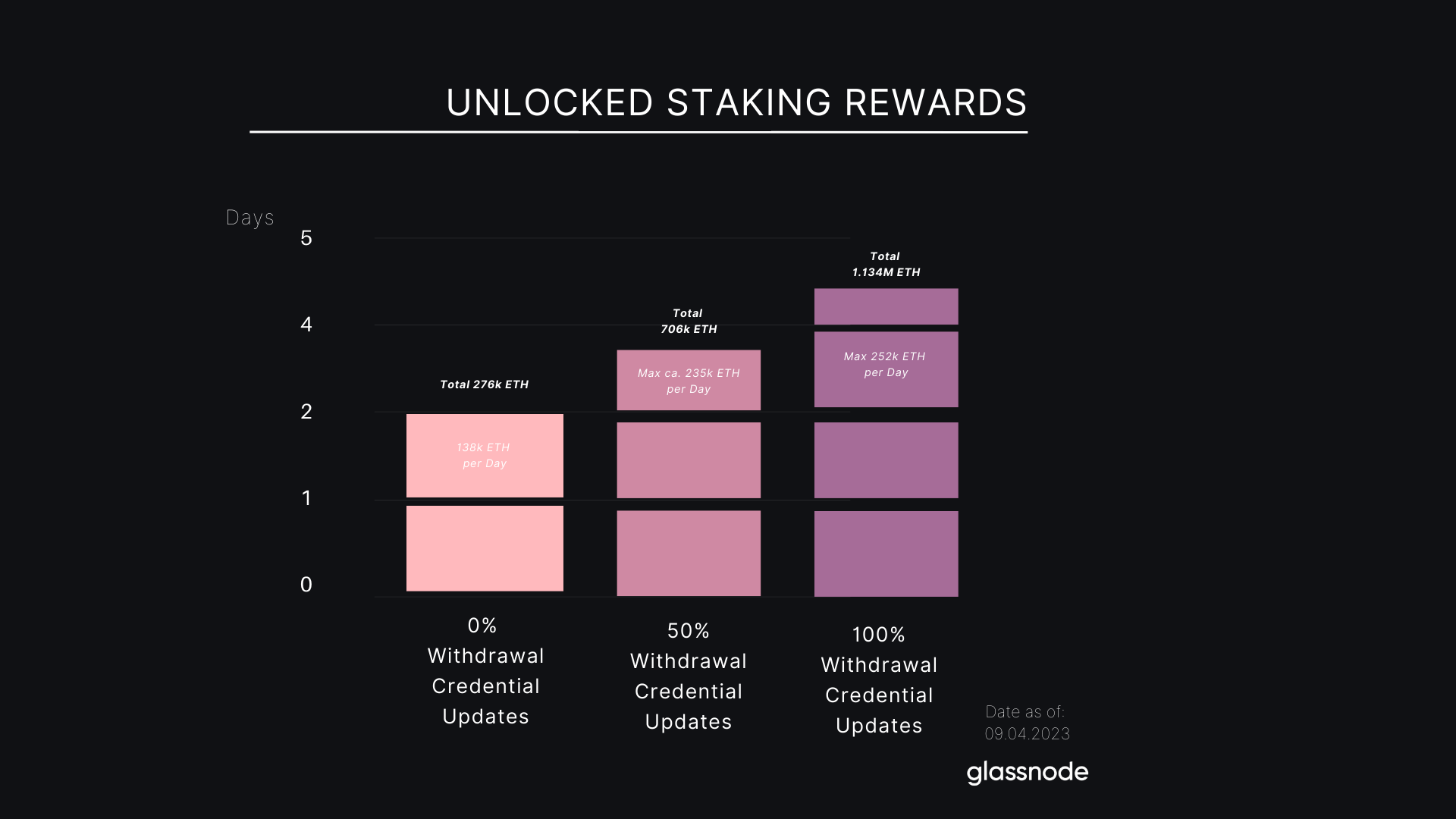

A full withdrawal will happen for those who have signed them, whereas partial ones will happen for those who haven’t. The scanning course of referred to right here, nevertheless, isn’t an on the spot course of. On the present variety of validators, the community will take as much as 4.5 days to finish the method. Presently, there are various validators that haven’t up to date their withdrawal credentials but.

“At present, round 300k validators must replace their withdrawal credentials, which is just doable after the Shanghai/Capella replace,” notes Glassnode. Primarily based on this, the analytics agency thinks that the automated scanning course of will take a most of two days.

Proper now, the locked contracts are holding staking rewards of about 1.137 million ETH ($2.1 billion). Ideally, these rewards can be routinely withdrawn as quickly because the improve would go stay, however as already talked about, not all of the buyers have up to date their withdrawal credentials.

Because it seems, the Ethereum validators who’ve the proper credentials personal simply 25% of the collected rewards, that means that solely about 276,000 ETH needs to be routinely withdrawn within the two days following the onerous fork.

If all of the validators replace their credentials as quickly because the improve goes stay, then 1.137 million can be withdrawn over the course of 4.5 days. Under are the completely different situations this will play out in:

ETH staking rewards unlock situations | Supply: Glassnode

Glassnode believes that the center state of affairs from the above picture is perhaps the closest to what is going to really comply with when the Ethereum Shanghai improve will go stay.

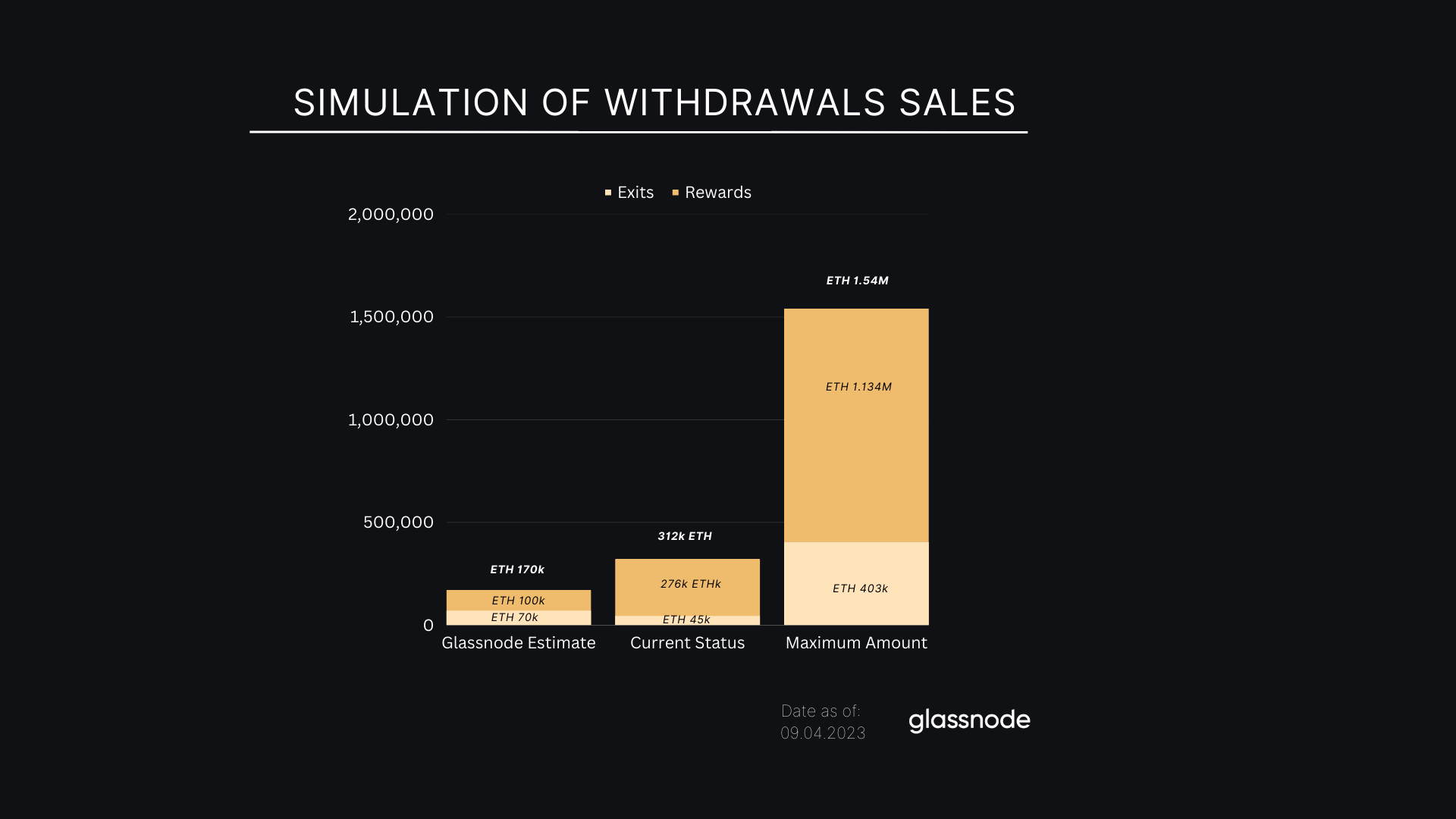

As for the situations relating to the total withdrawals, the agency notes that only one,800 validators can take part in these exits per day. Because of this proper after the onerous fork, solely a most of 57,600 ETH ($109.4 million) can be unstaked.

Primarily based on the variety of validators which have signed the voluntary exit message to date, although, the precise quantity that might be unstaked reduces to about 45,000 ETH ($84 million).

Now, listed below are the simulations made by Glassnode, making an allowance for each partial and full withdrawals, as to how the promoting strain might look within the first week after the Shanghai improve:

The varied estimates relating to the staking withdrawals | Supply: Glassnode

After making an allowance for numerous market components (like the truth that not all withdrawals will really find yourself being bought), Glassnode’s finest estimate is that about 170,000 ETH ($323M) can be bought on this occasion. This quantity is definitely not that important in any respect.

Even essentially the most excessive case with 1.54 million ETH being bought is just on the extent of the typical weekly alternate inflows, that means that the inflows would double if this state of affairs follows. Only a whereas in the past, comparable inflows have been noticed and the worth responded with an round 8.7% correction.

Whereas this can be a notable decline, it’s nonetheless nowhere close to the extent just like the FTX crash noticed again in November of final yr, the place the worth went down by round 30.2%.

“Given the Shanghai improve is broadly anticipated and understood, primarily based on this evaluation, the unlock occasion is on the same scale to day-to-day commerce for ETH markets, and is due to this fact unlikely to be as dire as many speculate it to be,” Glassnode concludes.

ETH Worth

On the time of writing, Ethereum is buying and selling round $1,800, up 5% within the final week.

ETH strikes sideways | Supply: ETHUSD on TradingView

Featured picture from DrawKit Illustrations on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link