[ad_1]

Crypto staking platforms have turn out to be more and more standard in recent times as a method for traders to earn rewards whereas holding their cryptocurrency. Staking includes holding a certain quantity of cryptocurrency in a pockets or on a platform to assist the operations of a blockchain community and in return, receiving a reward within the type of further cryptocurrency. Consider it like incomes curiosity on saving your money within the financial institution. With the rise of DeFi and the growing adoption of blockchain expertise, crypto staking has turn out to be a well-liked funding choice for many individuals.

Why do individuals stake crypto?

There are a number of the explanation why individuals use crypto staking platforms, with the obvious being the potential to earn passive revenue. Staking rewards generally is a supply of revenue for long-term cryptocurrency holders who will not be planning to half with their cash anytime quickly. It’s a low-effort methodology of creating a buck because it doesn’t require actively buying and selling or investing in different property. Moreover, staking generally is a strategy to assist the community and enhance its safety by turning into validators for the community, which generally is a profit for individuals who are dedicated to the long-term success of a selected blockchain challenge.

The distinction between staking and lending

Many crypto exchanges and wallets of sure cryptocurrencies supply rewards generated by way of lending or on-chain staking. When lending, you deposit your crypto right into a platform’s lending pool, which others then borrow at a hard and fast or variable fee. The platform attracts a fee for facilitating the lending whereas paying you the remaining yield.

With staking, alternatively, your property are locked up in a wise contract that’s ruled by the community’s proof-of-stake consensus. Your crypto is used to safe the community, verify transactions, and generate new blocks, and a fraction of the newly generated cash are then paid out to you. Remember that many staking platforms cost a charge or fee for his or her companies.

Concerns when selecting a crypto staking platform

Whether or not you’re staking or lending, particularly on crypto exchanges, try to be conscious that your funds will not be in self-custody. When deciding on a crypto staking platform to make use of, it’s essential to analysis the platform’s status and safety measures to make sure that your funds are protected. Moreover, search for platforms with a transparent and clear staking course of, together with details about charges, rewards, and the method for withdrawing funds. It’s additionally essential to contemplate the kinds of cryptocurrencies supported by the platform, in addition to the potential rewards for staking every one.

On this listicle, we are going to discover among the high crypto staking platforms available on the market at this time, highlighting their options and advantages, in addition to potential drawbacks or issues to remember. By offering an summary of among the finest choices out there, we hope to assist traders make knowledgeable selections about the place to stake their cryptocurrency and doubtlessly earn rewards.

High 15 crypto staking platforms

AllNodes

AllNodes is an all-in-one node internet hosting and staking platform that enables customers to simply stake 71 cryptocurrencies, together with Bitcoin, Ethereum, Polygon, and different standard cash. The platform offers customers with a easy and intuitive interface for managing their staked tokens and operating a node on the community.

The platform has a worth of over $2 billion throughout greater than 34,000 hosted nodes. It helps staking from {hardware} wallets and presents aggressive staking rewards starting from 3-35%, relying on the token.

Execs:

Helps a variety of cash for stakingCompetitive staking rewardsSimple and intuitive interface making it straightforward for novice customers to take part in staking

Cons:

No cell app, which can be inconvenient for some customers preferring to handle their staked tokens on the go

Everstake

A decentralized staking supplier based in 2018, Everstake makes use of enterprise-level {hardware} to run over 8,000 nodes for over 70 blockchain networks, together with Solana, Cosmos, Tezos, Polygon, and Cardano. The platform creates liquid staking merchandise like Eversol. Everstake has over 625,000 distinctive customers with $6.2 billion property staked.

Execs:

Helps a variety of cryptocurrenciesCompetitive staking rewards vary from 5%-49%, relying on the tokenUser-friendly interface and administration instruments

Cons:

Larger staking charges in comparison with another platformsNo cell app out there for managing staked tokens

Stakefish

Stakefish presents customers the flexibility to stake their tokens and earn rewards whereas serving to to safe quite a lot of blockchain networks. The platform operates validators for over 20 totally different protocols, together with Ethereum, Cosmos, and Polkadot, amongst others.

The platform has been working validators since 2018 and has established itself as one of many largest and most trusted validators within the crypto ecosystem. It helps over $1 billion value of property staked by each institutional and retail traders. Stakefish claims that its globally distributed workforce ensures 24-hour protection of its validator nodes, giving customers peace of thoughts.

Execs:

Aggressive staking rewards vary from 5%-62%, relying on the tokenOffers staking for greater than 20 totally different blockchain networks

Cons:

Restricted data out there about its safety measuresNo cell app out there

Lido

Lido is a decentralized staking platform that permits customers to earn staking rewards on their Ethereum holdings. The platform permits customers to stake their ETH, SOL, and MATIC tokens by way of a wise contract, which is then managed by a pool of validators.

The platform presents an a variety of benefits, together with the flexibility to stake any quantity of ETH, excessive staking rewards, and no minimal staking interval. Moreover, Lido’s staked ETH tokens are liquid and will be traded at any time. A complete of greater than 291,000 stakers have staked over 10 million tokens on the platform, with greater than $500,000 value of rewards paid out.

Execs:

Permits customers to stake any quantity of ETHStaking rewards from 4-6percentLiquid staked ETH tokens will be traded at any time

Cons:

Restricted to staking solely ETH, MATIC, SOL

SpoolFi

Spool is composable and permissionless DeFi middleware that connects Capital Aggregators with DeFi Yield Turbines to dynamically, robotically, and effectively allocate funds and guarantee optimized yields for customized methods managed by DAO-curated Danger Fashions.

The platform presents an infrastructure resolution to create and make investments utilizing “Sensible Vaults” to handle dangers. Customers can create customized Sensible Vaults tailor-made to their particular danger urge for food. As soon as property are deposited right into a Sensible Vault, Spool robotically manages and rebalances investments throughout numerous DeFi protocols, so customers don’t have to fret about paying any fuel charges. Customers also can earn a efficiency charge when others spend money on your Sensible Vault.

Execs:

Danger-managed strategy to yield farmingUsers can create customized Sensible Vaults tailor-made to their particular danger appetiteThe auto-rebalancing characteristic throughout numerous DeFi protocols ensures that customers don’t must pay any fuel charges

Cons:

The efficiency charge charged to Sensible Vault Creators might discourage some customers from creating their very own customized Sensible Vaults

MyCointainer

MyCointainer is a staking platform that helps over 100 cryptocurrencies. The platform presents safe and dependable node internet hosting companies, in addition to aggressive staking rewards of over 14% APY for customers.

The platform offers a user-friendly interface and a spread of instruments for managing staked tokens and monitoring rewards. The platform additionally presents a lot of different companies, together with a market for purchasing and promoting cryptocurrencies, crypto mining, and cashback on purchasing from over 2300 international retailers.

Execs:

No lockup interval for over 100 supported staking assetsClaims to supply day by day rewards and minimal feesMobile app for customers to handle their staking actions

Con:

No concrete data on staking charge/fee

Stader

Stader is a multichain liquid staking platform that enables customers to entry their property whereas incomes staking rewards. Not like the proof-of-stake system, the place person funds are locked up for a time period, liquid staking shops funds in DeFi escrow accounts in order that customers can entry their tokens every time they need, making their funds liquid. This allows customers to make use of their staked tokens as collateral for different monetary transactions, similar to lending, borrowing, and buying and selling, to generate a number of income streams.

The platform helps 9 networks, together with Ethereum, Fanton, BNB, Polygon, Close to, and extra.

Execs:

Elevated liquidity and suppleness.Retain management over your property whereas nonetheless with the ability to use them for different purposesPotential for increased returns as staked tokens can be utilized for different monetary transactions that generate further passive revenue.

Cons:

Could also be extra complicated and troublesome to make use of than conventional staking platforms, as liquid staking includes further monetary transactions and collateralizationRegulatory uncertainty of liquid staking might result in authorized and regulatory dangers for customers and suppliers of liquid staking companies

Stakely

A decentralized staking supplier constructed on the Ethereum community, Stakely is a non-custodial platform that helps near 40 tokens, together with ETH, FTM, DOT, and extra. The platform presents staking APY starting from 5-43%, relying on the token. It prices a 5% fee to cowl the prices of sustaining its infrastructure. It has a complete worth of greater than $612,000 locked and greater than 38,000 customers staking throughout 34 networks.

A proportion of the charges earned every month goes in direction of the Stakely Insurance coverage Program, which offers insurance coverage for delegators in case Stakely’s validators are affected by a slash incident. Slashing happens when a validator shows dangerous habits like downtime or poor efficiency, leading to a penalty of getting their bonded tokens slashed, that means that these tokens shall be misplaced.

Execs:

Staking insurance coverage ensures that property are secureLow fee feesNon-custodial platform. Customers don’t must switch funds to the platform’s validator

Cons:

Restricted number of supported cryptocurrencies.

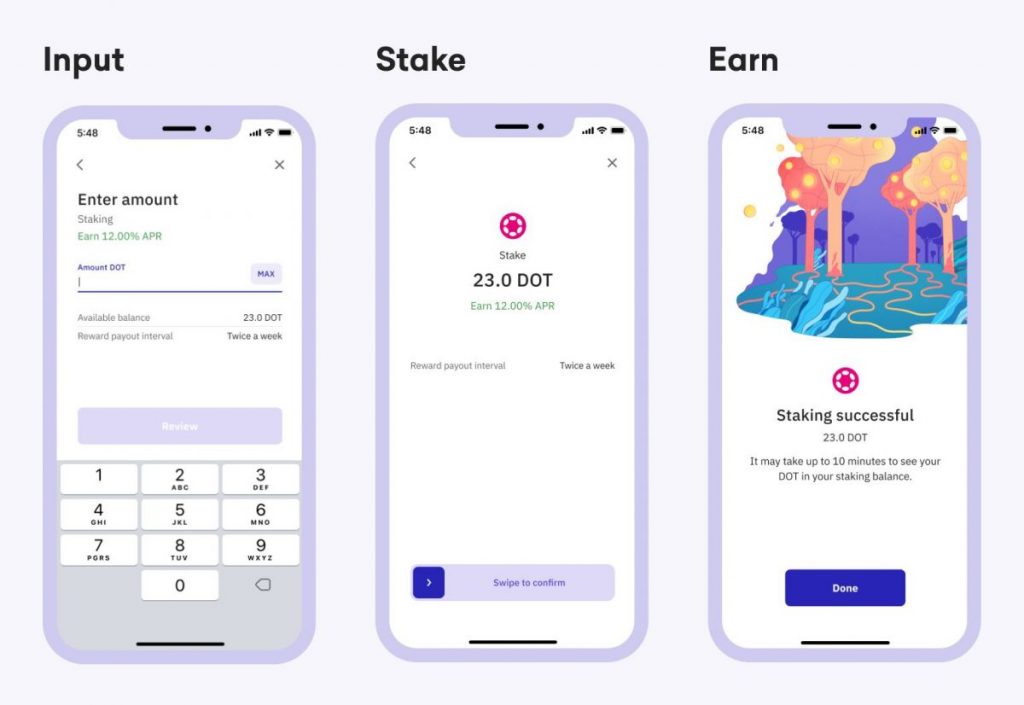

Ledger Reside

Ledger Reside is a crypto pockets and staking app that enables customers to securely retailer and handle their digital property, in addition to stake their cryptocurrencies to earn rewards. The platform helps a number of main cryptocurrencies, together with Bitcoin, Ethereum, and Tezos. With Ledger Reside, customers can simply stake their property with only a few clicks and profit from enticing yields. The platform additionally presents superior safety features, similar to multi-signature assist and {hardware} pockets integration, guaranteeing the protection and privateness of customers’ property.

Execs:

Over 400 cryptocurrencies supportedHardware pockets integration for added securityOption to earn staking rewards whereas sustaining management of personal keys

Cons:

No staking reward data for every tokenMay require some technical information for staking from a {hardware} pockets

Aave v2 Ethereum

Aave is a decentralized finance (DeFi) platform that provides staking companies by way of its Aave Protocol. Customers can earn rewards by staking their AAVE tokens or different supported property, similar to ETH and DAI. Staking rewards are distributed in AAVE tokens and will be claimed anytime. Previous to unstaking, customers should begin the cooldown interval of 10 days, adopted by a two-day window the place they’ll unstake. In the event that they miss that window, they must restart the cooldown course of.

Customers also can lend property to earn curiosity on them and borrow property with a secure or variable rate of interest.

Execs:

Staking characteristic is built-in with its lending and borrowing platform, so stakers can earn curiosity on their staked property whereas additionally incomes staking rewards

Con:s

Low staking rewards in comparison with different platformsOnly helps staking for a restricted variety of property

Ankr

Ankr is a blockchain infrastructure platform that provides delegated and liquid staking companies for a number of cryptocurrencies, together with ETH, BNB, and DOT. Customers can stake their cash by way of Ankr’s one-click node internet hosting service, which permits them to earn rewards whereas Ankr manages the technical points of operating a node. Moreover, the platform additionally presents a DeFi staking dashboard that permits customers to observe their staking exercise and rewards.

Execs:

Aggressive APY of as much as 16%, relying on a token

Cons:

Restricted variety of supported tokensSome property require a 14-day discover interval for withdrawal

Binance

Apart from being a crypto trade, Binance additionally presents staking companies for a big number of cash, together with ETH, BNB, USDT, and lots of extra. Customers can stake their cash by way of the trade and earn rewards which can be distributed on a weekly or month-to-month foundation.

It additionally presents versatile staking choices that enable customers to unstake their cash at any time with out penalties. Moreover, Binance presents a staking calculator that permits customers to estimate their potential rewards.

Execs:

Gives a variety of staking choices for a lot of totally different assetsHigh staking rewards in comparison with different platformsMobile app out there for straightforward staking and monitoring

Cons:

Binance is a centralized platform, which will be dangerous for stakers in case of a black swan eventSome customers might not really feel snug trusting their property to a centralized platformBinance has confronted some safety and regulatory points prior to now, though they’ve since taken steps to enhance safety measures

OKX

Like different standard crypto exchanges, OKX offers staking companies to its customers as an added worth. Customers can stake 80 cryptocurrencies on the platform, together with Bitcoin, Ethereum, and quite a lot of altcoins. Staking on OKX is easy and will be carried out by merely depositing the cryptocurrency into the staking pool; that’s all it’s good to be rewarded in further crypto. OKX additionally presents versatile staking so customers can unstake anytime with no penalty.

Execs:

Gives staking rewards for 80 cryptocurrencies, together with lesser-known onesA number of staking choices, together with versatile and fixed-term stakingHigh APY for fixed-term staking No fee charge

Cons:

The platform has confronted safety breaches prior to now, elevating considerations in regards to the security of person fundsSome customers have reported gradual buyer assist response occasions

Coinbase

Coinbase is a widely known cryptocurrency trade that additionally presents staking companies. Customers can stake 103 cryptocurrencies on the platform, together with Ethereum, Cosmos, and Algorand, and earn as much as 6% on crypto. Staking on Coinbase is user-friendly and will be carried out by way of the platform’s easy-to-use interface. The platform additionally presents a rewards calculator to assist customers estimate their potential earnings from staking. Moreover, Coinbase is insured in opposition to theft and hacking, offering an additional layer of safety for customers’ staked cash.

Execs:

Person-friendly interface that’s accessible to each novices and skilled tradersA well-established and respected firm with a powerful monitor report within the cryptocurrency business

Cons:

Coinbase prices a excessive staking charge, which may cut back the general returnsDoes not supply staking rewards for some standard cryptocurrencies like Bitcoin

Kraken

Regardless of having to close down staking for US customers, Kraken nonetheless presents staking companies to its customers in different nations. Ethereum, Polkadot, and Cosmos are amongst its 18 supported cryptocurrencies for staking. Apart from bonded staking, which presents the next APY, Kraken additionally presents versatile staking, permitting customers to decide on how lengthy they wish to stake their cash. Moreover, Kraken offers customers with entry to detailed staking experiences, enabling them to trace their earnings and monitor their staking exercise.

Execs:

Immediately unstake with no penaltiesNo charges for staking or unstaking

Cons:

Kraken’s staking service is just out there to sure areas, which can restrict its accessibility to some customers

Crypto staking platform cheat sheet

Cons:– No cell app

Everstake5 – 49percent6Pros:– Aggressive staking rewards– Person-friendly interface and administration instruments

Cons:– Comparatively excessive staking charges – No cell app

Stakefish5 – 62percent22Pros:– Aggressive staking rewards – Gives staking for over 20 totally different blockchain networks

Cons:– Restricted data on its safety measures– No cell app

Lido4 – 6percent5Pros:– Permits customers to stake any quantity of ETH– Liquid staked ETH tokens will be traded at any time

Cons:– Restricted to staking solely ETH, MATIC, SOL– No {hardware} safety system assist out there

SpoolFi2 – 25percentUSDC, USDT, DAIPros:– Danger-managed strategy to yield farming– Customized Sensible Vaults out there– Auto-rebalancing characteristic throughout numerous DeFi protocols

Cons:– Sensible Vault Creators are charged a excessive efficiency charge

MyCointainer4 – 153%~ 100Pros:– No lockup interval – Claims to supply day by day rewards and minimal charges– Cellular app

Cons:– No concrete data on staking charge/fee

Stader5 – 100percent7Pros:– Elevated liquidity and suppleness– Retain management over your property – Potential for increased returns as staked tokens can be utilized for different monetary transactions

Cons:– complicated and comparatively troublesome to make use of – Regulatory uncertainty of liquid staking might result in authorized and regulatory dangers

Stakely 5 – 43%~40Pros:– Staking insurance coverage – Low fee charges– Non-custodial platform

Cons:– Restricted number of supported cryptocurrencies– No data concerning fee charge

Ledger Liven/a> 400Pros:– Over 400 cryptocurrencies supported– {Hardware} pockets integration – Choice to earn staking rewards whereas sustaining management of personal keys

Cons:– No staking reward data for every token– Staking from a {hardware} pockets might require some technical information

Aave v2 EthereumUp to 14percentAAVE Token or Aave Balancer Pool Token (ABPT)Professional:– Staking characteristic built-in with its lending and borrowing platform

Con:– Low staking rewards– Helps staking for 2 tokens

Ankr3 – 16percent80Pros:– Gives staking rewards for 80 cryptocurrencies– A wide range of staking choices, together with versatile and fixed-term staking– Excessive APY for fixed-term staking – No fee charge

Cons:– The platform has confronted safety breaches– Sluggish buyer assist response time

BinanceUp to 104percent60+Execs:– Gives a variety of staking choices – Excessive staking rewards – Cellular app out there

Cons:– A centralized platform– Binance has confronted some safety and regulatory points prior to now

OKX0.1% – 56.8percent78Pros:– Gives staking rewards for almost 80 cryptocurrencies– A wide range of staking choices, together with versatile and fixed-term staking– Excessive APY for fixed-term staking.– No fee charge

Cons:– The platform has confronted safety breaches prior to now– Sluggish buyer assist response time

CoinbaseUp to sixpercent103Pros:– Person-friendly interface – A well-established and respected firm Cons:– Excessive staking charge– No staking rewards for some standard cryptosKraken1 – 24percent18Pros:– Immediately unstake with no penalties– No charges for staking or unstaking

Cons:– Service out there in sure areas– Restricted supported cryptocurrencies for staking

FAQ

How a lot cryptocurrency do I have to stake on a platform?

It will possibly differ relying on the platform and the particular cryptocurrency. Typically, platforms would require customers to stake a minimal quantity of cryptocurrency with a purpose to take part in staking. This quantity can vary from a number of hundred {dollars} to a number of thousand, relying on the platform.

What sort of rewards can I count on from staking on a platform and is a excessive yield sustainable long run?

In lots of instances, the rewards are a proportion of the staked cryptocurrency, paid out within the type of further cryptocurrency. The rewards can vary from a number of p.c to twenty% or extra, relying on the platform and the cryptocurrency being staked.

Nonetheless, a excessive yield supplied by a staking platform could also be unsustainable if the cryptocurrency value experiences a pointy decline, resulting in a lower within the worth of the staked property. As extra traders flock to a high-yield staking platform, the platform might turn out to be oversaturated, resulting in elevated competitors for staking rewards and doubtlessly inflicting the yield to lower over time.

How lengthy do I have to stake my cryptocurrency on a platform?

Staking durations can vary from a number of days to a number of months and even years. Some platforms supply versatile staking durations, permitting customers to withdraw their staked cryptocurrency at any time, whereas others require customers to decide to a selected time period.

Is staking on a platform protected?

It relies on the platform. It may be protected if the platform has sturdy safety measures in place. When selecting a platform, it’s essential to analysis its status, applied safety measures, and historical past of any safety incidents or hacks. Moreover, it’s essential to comply with finest practices for securing your cryptocurrency, similar to utilizing a {hardware} pockets and enabling two-factor authentication.

Can I lose my cryptocurrency by staking on a platform?

There’s all the time a danger of dropping cryptocurrency when staking on a platform. Nonetheless, the danger will be minimized by selecting a good platform with sturdy safety measures in place. Moreover, it’s essential to contemplate the dangers related to the particular cryptocurrency being staked, similar to market volatility or the danger of a tough fork.

Conclusion

Crypto staking platforms have made staking extra accessible to a wider vary of traders, permitting them to take part in community validation and earn rewards. Nonetheless, it’s essential to notice that staking is just not with out dangers. There’s all the time a chance of dropping some or all the staked cryptocurrency as a result of market fluctuations or different unexpected occasions. Be particularly cautious of platforms that provide excessive yields that appear too good to be true, as it could be unsustainable if the cryptocurrency value experiences a pointy decline, resulting in a lower within the worth of the staked property. Earlier than committing your funds, you need to rigorously analysis the platform and the value motion of the cryptocurrency you plan to stake.

Regardless of the dangers, crypto staking platforms supply a compelling funding choice for individuals who wish to earn passive revenue. With the growing adoption of blockchain expertise and the rising curiosity in cryptocurrency investments, it’s possible that crypto staking will proceed to realize recognition sooner or later. Because the business evolves, we will count on to see much more revolutionary staking options emerge, additional democratizing entry to this doubtlessly profitable funding choice.

Learn extra:

[ad_2]

Source link