[ad_1]

Be part of Our Telegram channel to remain updated on breaking information protection

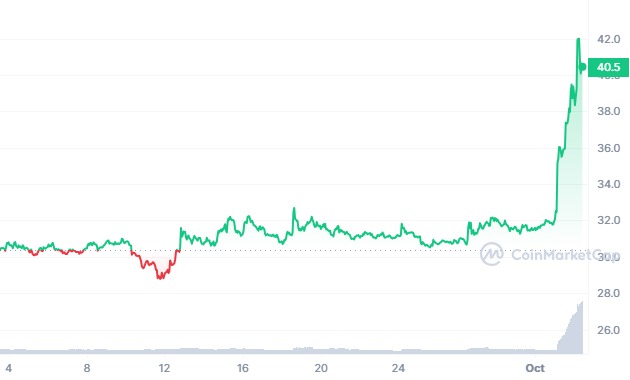

Bitcoin SV (BSV) worth has outperformed different cryptos since early September amid a triangle-triggered breakout. The hype surrounding exchange-traded funds (ETFs) has had a noticeable constructive affect on BSV, surging by 37% to highs above $40 in October alone.

Whereas main cryptos like Bitcoin (BTC) and Ethereum (ETH) wobbled on Monday after breaking out because of the approval of Ether futures, Bitcoin SV steadied the uptrend. In response to CoinMarketCap, BSV is up 12% to teeter at $40.33 on Tuesday in the course of the European session.

The rising curiosity within the token has seen the buying and selling quantity spike by greater than 212% to $228 million, whereas the market is up 12% to $777 million. BSV has reclaimed its place within the prime 50, rating #46 amongst different cryptos.

Bitcoin SV Value Tops $40, Can Bulls Push To $70?

Bitcoin SV worth presently holds above $40 following a minor correction from highs seen final in August at $43. The each day chart reveals a symmetrical triangle sample formation after BSV peaked at $54 in July, adopted by a big retracement to $27.

This symmetrical sample allowed Bitcoin SV to consolidate and prepare for the breakout in September. Though preliminary purchase orders ought to have been positioned after BSV stepped above the triangle resistance and notably above the resistance posed by the 50-day Exponential Shifting Common (EMA) (pink), the present technical image appears very important for a extra important breakout.

Bitcoin SV holds above most bullish indicators within the short-term, with the 100-day EMA (blue) and the 200-day EMA (purple) in line to supply assist. Nonetheless, to be secure, bulls should uphold greater assist at $40 to encourage already sidelined buyers to affix the uptrend with out worrying about sudden corrections.

A subsequent breakout above the quick assist at $43 would pave the way in which for a breakout that might full the triangle breakout goal – 155% above the trendline to $67.

Primarily based on the Relative Power Index (RSI), the presently overbought situations would possibly culminate in a reversal. The RSI holds above 80, barely greater than its July excessive of 77.61, which preceded the downtrend in July and August.

That mentioned, it may be prudent to keenly be careful for the RSI’s rejection from the overbought area to time the reversal to keep away from the bull lure rigorously.

Bitcoin SV upholds the bullish outlook in shorter timeframes such because the four-hour chart. The Directional Motion Index (DMI) reinforces the bullish grip, with the +DI holding considerably above the -DI.

This indicator measures the route and energy of the pattern. A pattern reversal could be imminent as quickly because the route of the index reverses. As an example, the +DI (blue) drops whereas the -DI rises.

As seen earlier, assist at $40 is vital for the uptrend’s continuation. With the anticipated breakout above the $43 resistance, Bitcoin SV could be on the way in which to highs above $50 and ultimately obtain the triangle’s 115% goal of $67.

Crypto analysts like InvestingScope, who posts content material on Tradingview, consider that the standard pullback after an enormous climb into the overbought could not happen because the weekly MACD has simply despatched out a purchase sign along with holding above the impartial stage (0.000).

“This implies that the upside potential is massive in case of a breakout. Goal the R1 stage (TP = 56.450), which is the strongest Resistance presently as it’s the place the 1W MA100 is headed.”

Bitcoin SV Different To Purchase – Bitcoin Minetrix

Buyers within the crypto market know very nicely to not put all their eggs in a single basket. Therefore, portfolio diversification is the least an investor can do to attenuate danger.

One solution to handle danger is to search for crypto initiatives with immense potential and purchase into them throughout their presale phases.

That mentioned, Bitcoin Minetrix (BTCMTX) is a revolutionary platform already tokenizing cloud mining, permitting on a regular basis buyers to mine Bitcoin (BTC) in a decentralized but safe method.

With Bitcoin Minetrix, buyers overlook in regards to the points related to third-party cloud mining scams. Which means that buyers have absolute management over the complete course of by following a easy staking course of (BTCMTX) to earn credit which are utilized to mine BTC. Cloud mining ensures that buyers don’t want costly tools to mine BTC.

#BTCMTX supplies a dependable cloud mining answer that caters to each #Crypto aficionado.

Previous fears of pricey {hardware} and cloud mining scams deterred many from getting into.

This decentralized method ensures a mining expedition that’s each clear and safe. 🔐 pic.twitter.com/hk2reUiJ7x

— Bitcoinminetrix (@bitcoinminetrix) October 2, 2023

The mining course of begins with the buyers shopping for BTCMTX tokens within the ongoing presale utilizing a self-custody pockets like MetaMask. These tokens are then staked in a wise contract to earn non-tradable ERC-20 token credit, that are then burned to earn BTC cloud mining energy.

Buyers have channeled $373k into the BTCMTX presale inside two weeks. There may be nonetheless an funding window, the place you should purchase 1 BTCMTX token for $0.011 because the staff appears ahead to elevating $3 million to launch the mission absolutely.

Associated Articles

Be part of Our Telegram channel to remain updated on breaking information protection

[ad_2]

Source link