[ad_1]

On-chain knowledge reveals {that a} bullish mixture has simply fashioned for Bitcoin, which can sign {that a} rally could possibly be forward for the asset.

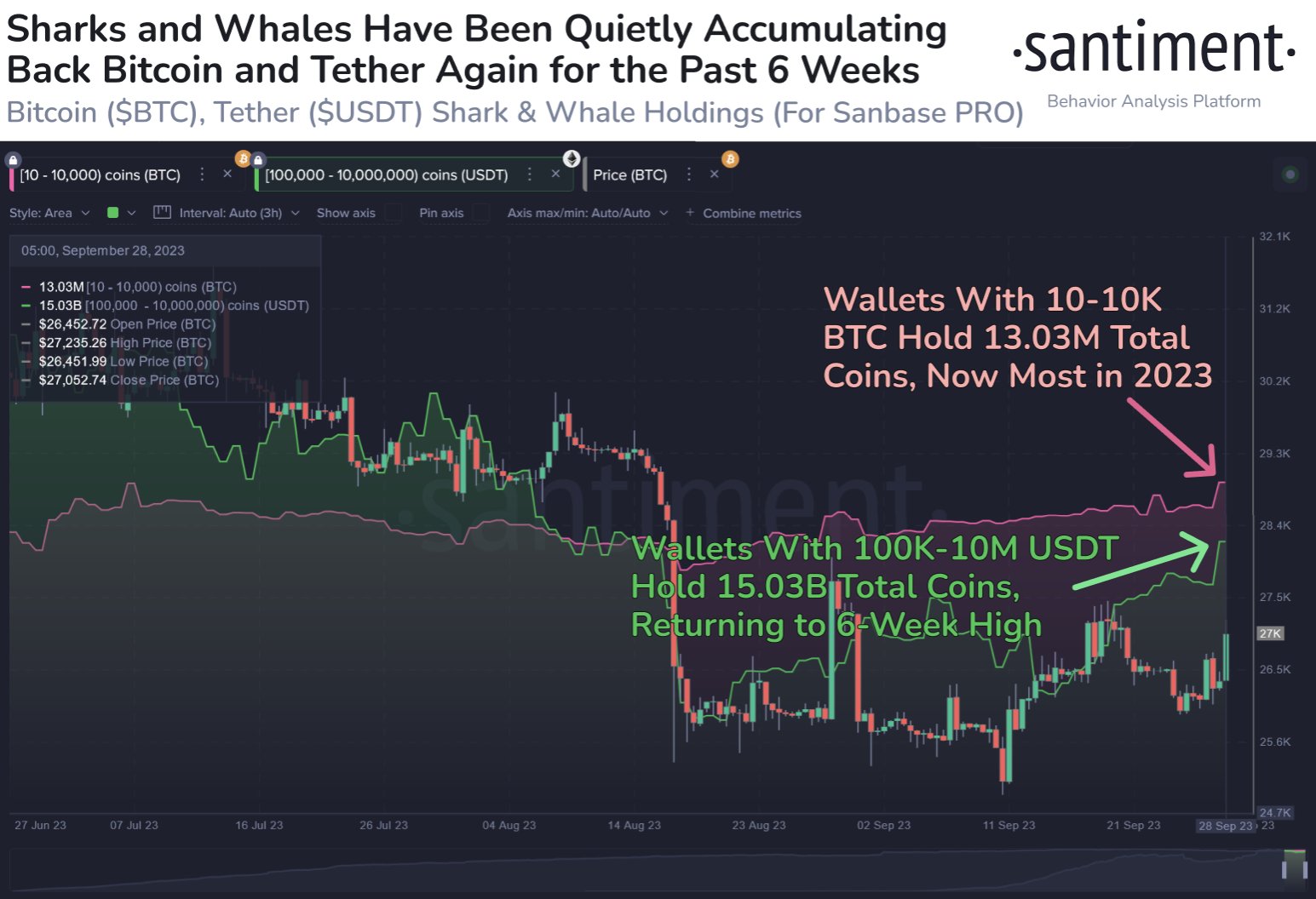

Sharks & Whales Are Accumulating Each Bitcoin, Tether Proper Now

In line with knowledge from the on-chain analytics agency Santiment, each the sharks and whales of BTC and USDT have been accumulating lately. The metric of curiosity right here is the “Provide Distribution,” which retains monitor of the whole quantity of a given asset that the completely different holder teams carry.

Within the present matter, sharks and whales are the entities of curiosity. For Bitcoin, the mixed provide of those property could also be outlined as the ten to 10,000 BTC vary, whereas for Tether, it’s typically 100,000 to 10 million USDT.

The sharks and whales are influential entities within the sector attributable to their holdings, however their function differs between whether or not they’re holding the unstable BTC or the stablecoin USDT.

The chart under reveals how the provides of the sharks and whales of the 2 cryptocurrencies have modified over the previous few months:

Each of those metrics seem to have registered a rise throughout the previous few days | Supply: Santiment on X

The graph reveals that the Bitcoin sharks and whales have participated in some accumulation lately, which has taken their provide to 13.03 million BTC, a brand new excessive for the 12 months.

Apparently, whereas this accumulation has occurred, the sharks and whales of Tether have additionally expanded their holdings. The metric’s worth, on this case, has reached a six-week excessive of 15.03 billion USDT.

The importance of the development within the provide of the BTC sharks and whales could appear simple: these humongous entities are shopping for proper now, in order that needs to be bullish for the worth. However what concerning the sample being proven by the USDT cohort?

Typically, an investor could purchase right into a stablecoin like USDT to keep away from the volatility of property like Bitcoin. As soon as these holders really feel that the costs are proper to leap again into the unstable facet of the sector, they change their fiat-tied tokens for his or her desired coin.

This shift can naturally present shopping for strain on no matter cryptocurrency they’re swapping into. Due to this cause, a technique to take a look at the provision of a stablecoin is as a measure of the out there potential shopping for energy for Bitcoin and different property out there.

Thus, the most recent Tether accumulation would counsel that the sharks and whales have elevated their shopping for capability. Generally, spikes on this indicator come on the expense of the corresponding BTC metric, as these holders convert their reserves. Whereas the shopping for energy goes up for the long run in such a state of affairs, it has solely come on the expense of a BTC selloff.

Within the present case, although, each of those indicators have trended up on the similar time, which implies that not solely have the sharks and whales participated in some Bitcoin buying, however the capital reserves that these giant holders could deploy into the asset within the type of Tether have additionally gone up. “That is typically a bullish mixture,” explains Santiment.

BTC Worth

Bitcoin had earlier risen above the $27,000 stage, however the asset has retreated previously few hours as it’s now buying and selling across the $26,700 mark.

BTC has already retraced a few of its restoration | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, charts from TradingView.com, Santiment.web

[ad_2]

Source link