[ad_1]

On-chain information from Glassnode exhibits 96.9% of Bitcoin short-term holders are in revenue following the asset’s rally above the $30,000 stage.

Bitcoin Rally Has Taken A Giant Quantity Of Quick-Time period Holders Into Revenue

In line with information from the on-chain analytics agency Glassnode, 2.6 million cash held by the short-term holders are actually carrying some unrealized revenue. The “short-term holders” (STHs) right here discuss with all these buyers who’ve been holding onto their cash since lower than 155 days in the past.

Statistically, the longer an investor holds their cash, the much less doubtless they turn out to be to promote mentioned cash at any level. Thus, for the reason that STHs haven’t been holding their cash since that way back, they’re the weak arms of the market who could simply promote on the sight of FUD or profit-taking alternatives.

However, the counterpart group to the STHs, the “long-term holders” (LTHs), consists of the buyers with a robust conviction (a undeniable fact that has additionally earned them the identify the “diamond arms” of the market).

As the worth of Bitcoin has noticed a pointy rally lately, it’s not surprising that lots of STHs could be carrying notable earnings proper now. Normally, the extra the buyers enter into earnings, the extra doubtless they turn out to be to be swayed into realizing these beneficial properties. Thus, the danger of mass promoting occurring can improve when there are lots of holders carrying earnings.

An indicator that retains monitor of such earnings is the “% provide in revenue,” which calculates the share of the entire Bitcoin provide that’s at the moment holding an unrealized acquire.

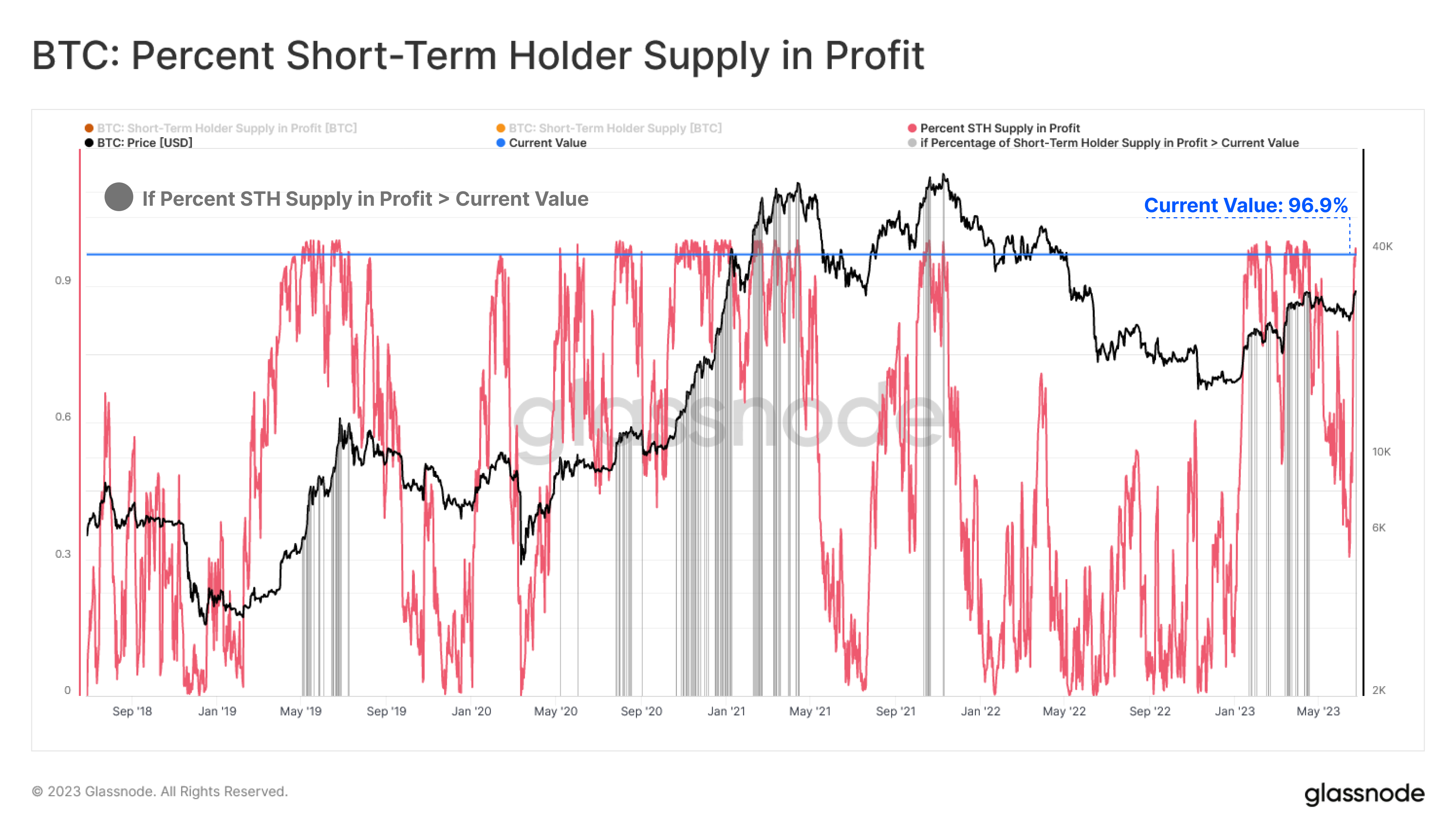

Here’s a chart that exhibits the development on this metric particularly for the STHs over the previous few years:

The worth of the metric appears to have noticed a pointy leap in current days | Supply: Glassnode on Twitter

As you’ll be able to see within the above graph, the Bitcoin STH provide in revenue had gone by means of a decline lately because the asset’s worth had been struggling. With the newest sharp rally above the $30,000 mark, nonetheless, the indicator has seen a revival, as its worth has noticed speedy progress.

Following this newest spike, the metric’s worth has hit 96.9%, that means that 96.9% of the complete provide held by the STHs is now carrying some quantity of unrealized revenue.

Within the chart, Glassnode has additionally marked the historic cases the place an identical or bigger a part of the STH provide was in revenue. It appears to be like like lots of such spikes prior to now have coincided with tops for the cryptocurrency.

As defined earlier than, this development would make sense as at these excessive ranges of earnings, a lot of STHs could also be inclined to take part in profit-taking, resulting in the worth registering a drawdown.

Although, the newest surge within the Bitcoin STH provide in revenue doesn’t essentially spell doom for the present rally, as usually, such tops have solely been native highs, and a few of the occurrences of this sample haven’t resulted within the worth rise slowing down in any respect.

It now stays to be seen whether or not the market can take in the profit-taking that might be going down on the present worth ranges, or if the asset would quickly observe a pullback.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $30,200, up 15% within the final week.

Appears to be like like BTC has noticed a speedy surge | Supply: BTCUSD on TradingView

Featured picture from André François McKenzie on social Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link