[ad_1]

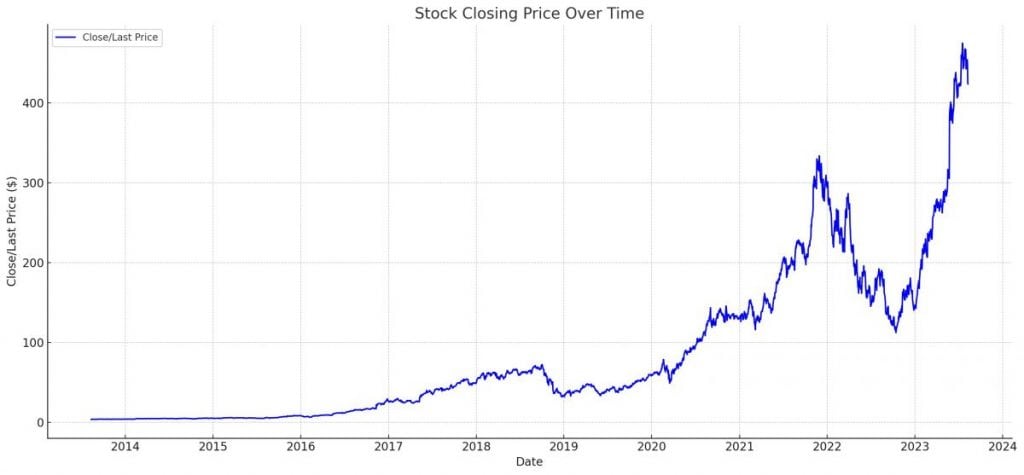

Nvidia, the primary chipmaker to succeed in a market capitalization of $1 trillion, skilled vital progress between fiscal 2013 and 2023. The corporate’s income and adjusted internet earnings grew at a CAGR of 20% and 28%, pushed by the PC gaming {and professional} visualization markets. Nonetheless, the pandemic and the rise of cloud-based providers led to a decline in income from the gaming market. In fiscal 2023, Nvidia’s income remained flat, and adjusted EPS fell 25%. Analysts now anticipate Nvidia’s income and adjusted EPS to surge 58% and 34% this 12 months, driving a stampede of bulls again to its inventory. If Nvidia’s valuations maintain regular and it doubles its income and earnings once more, it may attain a $2 trillion market cap by 2030. Nonetheless, Nvidia’s inventory is presently expensive at 218 instances its trailing earnings and 37 instances final 12 months’s gross sales. If its progress slows to a ten% CAGR over the following seven years, its valuations may very well be minimize in half, indicating that its market cap may keep round $1 trillion by the top of the last decade.

Nvidia will obtain a major milestone in 2030 when its market capitalization reaches $2 trillion. This accomplishment will probably be made potential by quite a lot of components, considered one of which is the numerous buy of Nvidia chips by well-known Chinese language tech corporations. Not solely does the acquisition of Nvidia chips by well-known Chinese language tech corporations enhance Nvidia’s income, but it surely additionally cements the corporate’s place because the world’s high provider of superior computing options. Nvidia will have the ability to broaden its affect and carve out a major place for itself within the quickly growing Chinese language expertise market because of this strategic alliance.

1. Substantial Orders by Chinese language Tech Majors

4 main Chinese language tech entities – Baidu, ByteDance, Tencent, and Alibaba – collectively positioned orders valued at $1 billion. The cumulative order encompassed round 100,000 Nvidia A800 chips, with supply set for the top of the identical 12 months. These corporations additionally scheduled one other order, valued at $4 billion, for 2024 supply. The substantial orders positioned by these Chinese language tech majors point out their robust demand for Nvidia A800 chips, that are recognized for his or her high-performance capabilities. This partnership highlights the businesses’ dedication to staying on the forefront of technological developments and their anticipation of future progress within the business. Chinese language tech giants will order increasingly.

2. Important Function of Nvidia Chips in AI

The rising significance of Synthetic Intelligence in modern-day functions has created a surge in demand for highly effective chips. Nvidia chips, such because the A800, are integral parts in the case of creating superior AI fashions. The sheer magnitude of the order from China’s tech giants underlines the chips’ pivotal function in AI expertise improvement. These chips are particularly designed to deal with complicated computations and speed up AI algorithms, making them indispensable for coaching deep studying fashions. With China’s tech giants closely investing in AI analysis and improvement, the demand for Nvidia chips is predicted to proceed rising within the foreseeable future.

3. Potential Export Restrictions

A looming concern for a lot of corporations internationally has been the potential of a brand new US export ban. This apprehension performed a task within the Chinese language corporations’ determination to safe Nvidia chips in massive portions, making certain that their AI developments are usually not hindered by geopolitical developments. Many Asian corporations have acknowledged the criticality of Nvidia chips in driving their AI developments and are taking proactive measures to safeguard their progress. By stockpiling these chips, they intention to mitigate any potential disruption attributable to the unsure way forward for US export insurance policies, thereby making certain a easy continuation of their technological developments.

4. Options of the Nvidia A800

The A800 is a streamlined model of its counterpart, the A100. Whereas the A800 has a decreased knowledge price compared, its demand stays unwavering because of the non-availability of the A100 mannequin. Prospects proceed to depend on the A800 for its dependable efficiency and cost-effectiveness, regardless of the decrease knowledge price. The A800’s recognition additionally stems from its compatibility with present techniques, making it a handy alternative for companies in want of a dependable resolution.

5. Dependency on Nvidia for LLM Coaching

Giant Language Fashions (LLMs) signify the forefront of AI expertise, and their coaching is closely reliant on subtle chips. Within the absence of Nvidia’s expertise, the capabilities of corporations to coach these superior fashions can be significantly compromised. Nvidia’s expertise, comparable to their highly effective graphics processing items (GPUs), offers the required computational energy for coaching massive language fashions. These GPUs are particularly designed to deal with the complicated calculations required for AI coaching, enabling corporations to realize sooner and extra environment friendly mannequin coaching. With out entry to Nvidia’s expertise, corporations would face vital challenges in harnessing the complete potential of enormous language fashions and advancing AI analysis.

Nvidia’s valuation could be difficult to beat, however its dominance within the semiconductor business stems from its software program capabilities. Nvidia’s robust software program platform has attracted cloud suppliers to improve to Nvidia chips. Nonetheless, if income and earnings progress decelerate to a ten% CAGR over the following seven years, it’s unlikely to maintain its present valuations. To achieve a $2 trillion valuation, Nvidia would wish to commerce at 21-times trailing gross sales, which depends on sustaining its premium valuation.

Learn extra about AI:

[ad_2]

Source link