[ad_1]

The Bitcoin and crypto markets have had a particularly bullish week. Whereas the BTC worth has risen by 14.5% within the final seven days, reaching a brand new yearly excessive of $31,432, the whole market capitalisation of the crypto market has elevated by 10.7%.

The market continued to soar on information of the BlackRock Bitcoin ETF, bucking a worth consolidation within the US fairness markets. Nonetheless, it stays to be seen whether or not this rally can proceed or the bulls will run out of steam. Within the coming week, 5 occasions specifically will come into focus that would set the development for costs on the Bitcoin and crypto markets.

Fed And Macro Knowledge In The Highlight

On Wednesday, June 28, US Federal Reserve (Fed) chairman Jerome Powell will as soon as once more seem in entrance of the cameras. After Powell needed to testify earlier than the US Congress on numerous subjects final week, the main focus this time will once more be on the present rate of interest and financial coverage.

It’s probably that the Fed Chair will reiterate his hawkish stance and the Fed’s knowledge dependence. Solely surprises are more likely to have a (unfavorable) impression in the marketplace, which, in keeping with the FedWatch Device, is anticipating one other 25 foundation factors (bps) hike in July with 72% anyway.

However the Fed’s outcomes on the stress take a look at of banks within the US may be fairly attention-grabbing on Wednesday. In view of a number of emergency interventions and the nonetheless growing use of the Financial institution Time period Funding Program (BTFP), the report is eagerly awaited. The market can be watching intently to see how wholesome the banking system is and which banks might fail the take a look at.

If quite a few banks don’t go the take a look at, that is more likely to have an effect on the monetary markets. Already in March, dwindling confidence within the US banking system precipitated an upward development in BTC. Moreover that, the US greenback index (DXY) might come underneath additional strain, offering a tailwind for Bitcoin and crypto costs.

On Thursday, June 29, the U.S. Bureau of Financial Evaluation will launch the newest preliminary U.S. gross home product (GDP) figures for the primary quarter of 2023 at 8:30 am EST. The forecast is 1.4%, as soon as once more stronger than final time (1.3%).

Despite the fact that this nonetheless leaves US GDP nicely under 2%, confirming or exceeding the forecast might level to a stabilization of the US economic system. The broader monetary market in addition to the Bitcoin and crypto markets will most likely take this positively. If, however, the present estimate is missed, a bearish response might be anticipated.

On Friday, June 30, the Bureau of Financial Evaluation will launch the core PCE (Private Consumption Expenditures) for Could at 8:30 am EST. In April, the core PCE was +0.4% on a month-on-month foundation, once more above the forecast of +0.3%. For Could, analysts anticipate an extra enhance of +0.4%. On an annual foundation, analysts anticipate 4.7%, no change from April (additionally 4.7%).

Remarkably, core inflation stays the main focus of the Fed, as it’s at the moment proving to be the “stickiest”. On this respect, core PCE might have an necessary impression on the chance of one other charge hike by the Fed. The crypto market will subsequently intently monitor the info and is more likely to react accordingly.

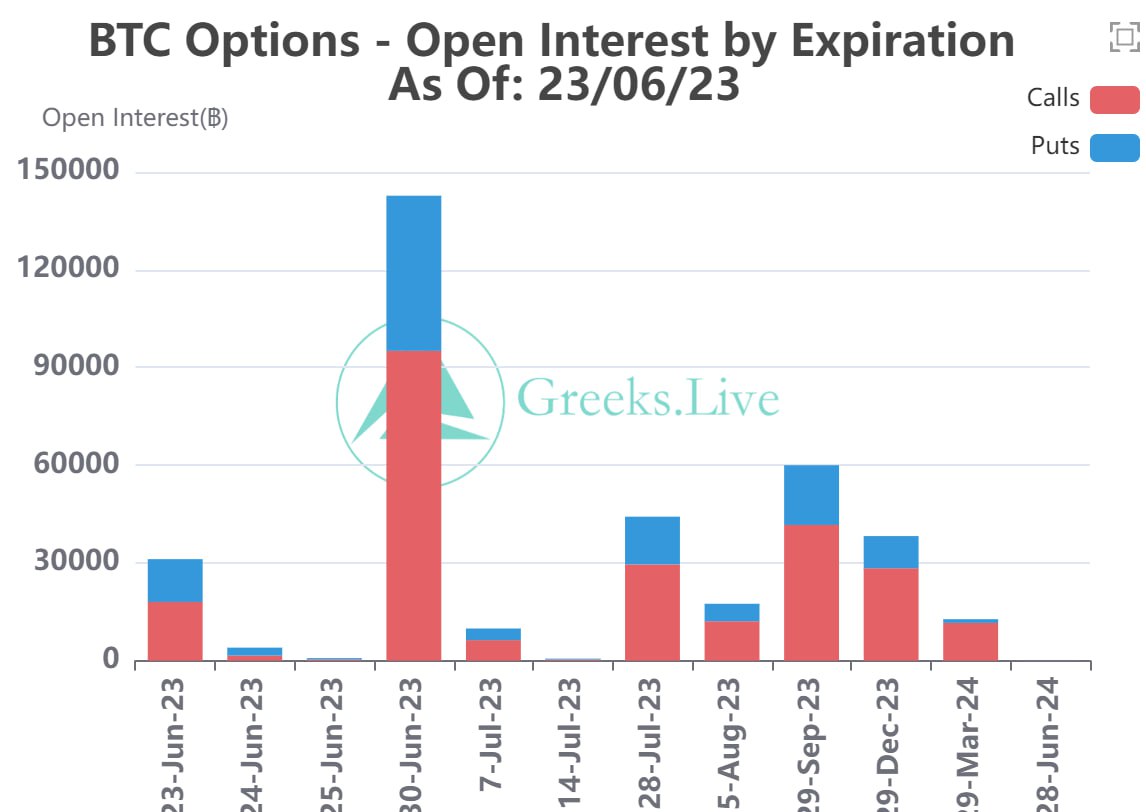

$5 Billion In Bitcoin Choices Set To Expire

The upcoming Friday may even be necessary for the Bitcoin marketplace for different causes. First, BTC will shut its month-to-month and quarterly candle, and second, a record-breaking quantity of over $5 billion in Bitcoin choices will expire on June 30. The occasion might trigger a pointy enhance in volatility for a short while.

At press time, the Bitcoin worth stood at $30,250 after taking a breather over the weekend.

Featured picture from iStock, chart from TradingView.com

[ad_2]

Source link