[ad_1]

Key Takeaways

Regulators are clamping down arduous on the US crypto trade, with latest lawsuits introduced in opposition to Binance and Coinbase

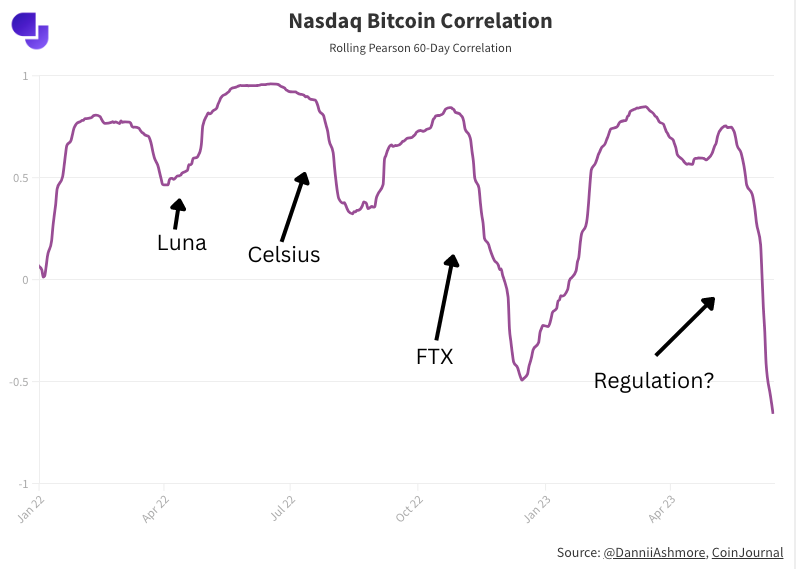

Bitcoin’s correlation with shares is at a 5-year low, with the latter hovering however Bitcoin’s worth suppressed by considerations round way forward for trade in US

Exchanges have seen web outflows for 33 days in a row, however measurement of withdrawals will not be notably notable

Binance is seeing the most important withdrawals, 7.3% of its stability heading for the exit doorways

Allegations in opposition to Binance transcend securities violations which most centralised firms are dealing with

Binance’s battle with the SEC goes on. As does Coinbase’s. As does, nicely, your complete cryptocurrency area, which out of the blue faces a regulatory menace that feels existential for the crypto trade within the US.

The market has responded, unsurprisingly, by promoting. Bitcoin dipped beneath $25,000 for the primary time in three months final week, earlier than bouncing again to the place it at the moment trades at $26,500.

Extra notable, nevertheless, was that this got here amid a time when the inventory market is hovering. As I detailed in depth final week, the correlation between shares and Bitcoin is now at a 5-year low. That is much like the dip in correlation we noticed in November when FTX collapsed whereas the inventory market surged off softer-than-expected inflation numbers.

In such a method, whereas Bitcoin’s worth decline appears minor on the face of issues, it’s underperforming comparatively as the remainder of the market is purple scorching.

In such a method, whereas Bitcoin’s worth decline appears minor on the face of issues, it’s underperforming comparatively as the remainder of the market is purple scorching.

Bitcoin on exchanges

However past worth, how are markets reacting? Are folks once more involved about storing their belongings with these centralised exchanges?

Effectively, trying on the whole quantity of Bitcoin sitting in these exchanges, there was web outflows for 33 days in a row. That’s the longest streak since November 2022 amid the FTX scandal.

The size of withdrawals just isn’t the identical, nevertheless. Again in November, the final time we noticed a constant stream of web withdrawals, FTX was uncovered as bancrupt (and fraudulent) with $8 billion of buyer belongings gone. Worry was excessive and your complete market panicked, involved that different exchanges might comply with. Bitcoin ran for the exit doorways, a lot of it despatched straight to chilly storage (or bought for money).

Whereas the present developments are regarding for crypto in their very own method, there seems to be no worry that buyer belongings are in peril. This isn’t a repeat of FTX, and the market response can be considerably extra muted.

Certainly, if we have a look at the whole stability of Bitcoin throughout exchanges, we are able to see that the latest dip doesn’t stand out within the context of the steep downtrend we have now seen for the reason that begin of 2020.

Is Binance totally different?

However what about Binance? Accusations levelled on the world’s greatest crypto alternate are actually extra sordid than merely securities violations. Binance and CEO Changpeng Zhao have been accused of buying and selling in opposition to clients, manipulating commerce quantity, failing to implement satisfactory cash laundering procedures, encouraging US clients and VIPs to avoid location-based restrictions, and commingling buyer funds.

It’s the latter accusation which is the headline one and throws up painful recollections of FTX. Whereas I’ve been important of Binance for working in an extremely opaque method (they’ve at all times refused to disclose their liabilities), there was no proof so far that buyer funds have been misappropriated as they have been within the FTX case. Once more, this actually has little in widespread with the FTX state of affairs.

On Saturday, a US court docket even authorised an settlement between Binance and the SEC that may dismiss a brief restraining order to freeze all Binance.US belongings.

“We’re happy to tell you that the Courtroom didn’t grant the SEC’s request for a TRO and freeze of belongings on our platform which was clearly unjustified by each the information and the regulation,” Binance.US mentioned on Twitter.

This seems to have assuaged the doomsday situation, no matter likelihood there was of that to start with. In trying on the flows on Binance particularly, nevertheless, it has seen extra outflows than some other main alternate. 7.3% of its Bitcoin stability was withdrawn within the two weeks for the reason that lawsuit was introduced on June fifth. That equates to 52,000 Bitcoin, or about 0.3% of the whole circulating provide.

For context, when Binance got here beneath fireplace for its lack of transparency round reserves after FTX collapsed, 13.3% of its Bitcoin stability was withdrawn in an identical two-week interval – evidently greater as seen on the above chart, almost double the flows of what have been seen so far amid this SEC case.

What does this all imply? Not very a lot, actually. Binance has lengthy operated within the shadows, and as I wrote right here upon the SEC’s case being introduced, it was a day that had lengthy been coming. However there shouldn’t be a sudden uptick in concern across the security of buyer funds, and that’s mirrored within the comparatively small move of funds out of the platform.

Nonetheless, the allegations in opposition to Binance are excess of merely promoting unregistered securities, which is the principle sticking level throughout the trade (and what Coinbase is being sued for). It is for that reason that funds have moved out of Binance at a sooner tempo than different exchanges, even when the scale of those is not any cause for alarm.

All in all, the response is no surprise. Nor have been the information of those lawsuits, actually.

[ad_2]

Source link