[ad_1]

Cardano (ADA) is at the moment buying and selling at a pivotal $0.291. The query is: Will ADA expertise a 28% upswing or is a 23% drop on the horizon? Remarkably, the ADA value nonetheless stays in bearish territory, however the potential for a development reversal is palpable.

Worth Evaluation: 4-Hour Chart

The 4-hour chart paints an image of ADA buying and selling only a smidge above the 23.6% Fibonacci retracement stage, which stands at $0.286. Notably, on Monday, ADA briefly dipped beneath this stage however was buoyed by the ascending development line (black line) that was established in mid-June. This development line is the bulls’ final stand; a breach may see a bearish descent to the yr’s low of $0.22.

Including one other layer of complexity, the 200-EMA (blue line) on the 4-hour chart is converging in the direction of the 23.6% Fibonacci stage. ADA’s latest incapability to surpass the 20-EMA (purple line) is regarding. With the transferring averages trending downward, a compression between $0.28 and $0.30 appears inevitable.

Nonetheless, if ADA stays resilient above the 23.6% Fibonacci retracement stage and the trendline, and manages to interrupt the transferring averages, particularly the 200-EMA, then the bulls would possibly simply have a preventing probability.

On this state of affairs, the 38.2% Fibonacci at $0.319, the 50% Fibonacci at $0.346, and the 61.8% Fibonacci at $0.378 grow to be the following logical targets. A day by day shut above $0.38 (July’s excessive) can be a clarion name for the bulls, marking a 28% rallye from the latest value.

Bullish Arguments for Cardano

The latest value actions by Cardano could be bearish, however there are compelling arguments in favor of ADA’s potential resurgence. Santiment, a famend analytics platform, not too long ago tweeted:

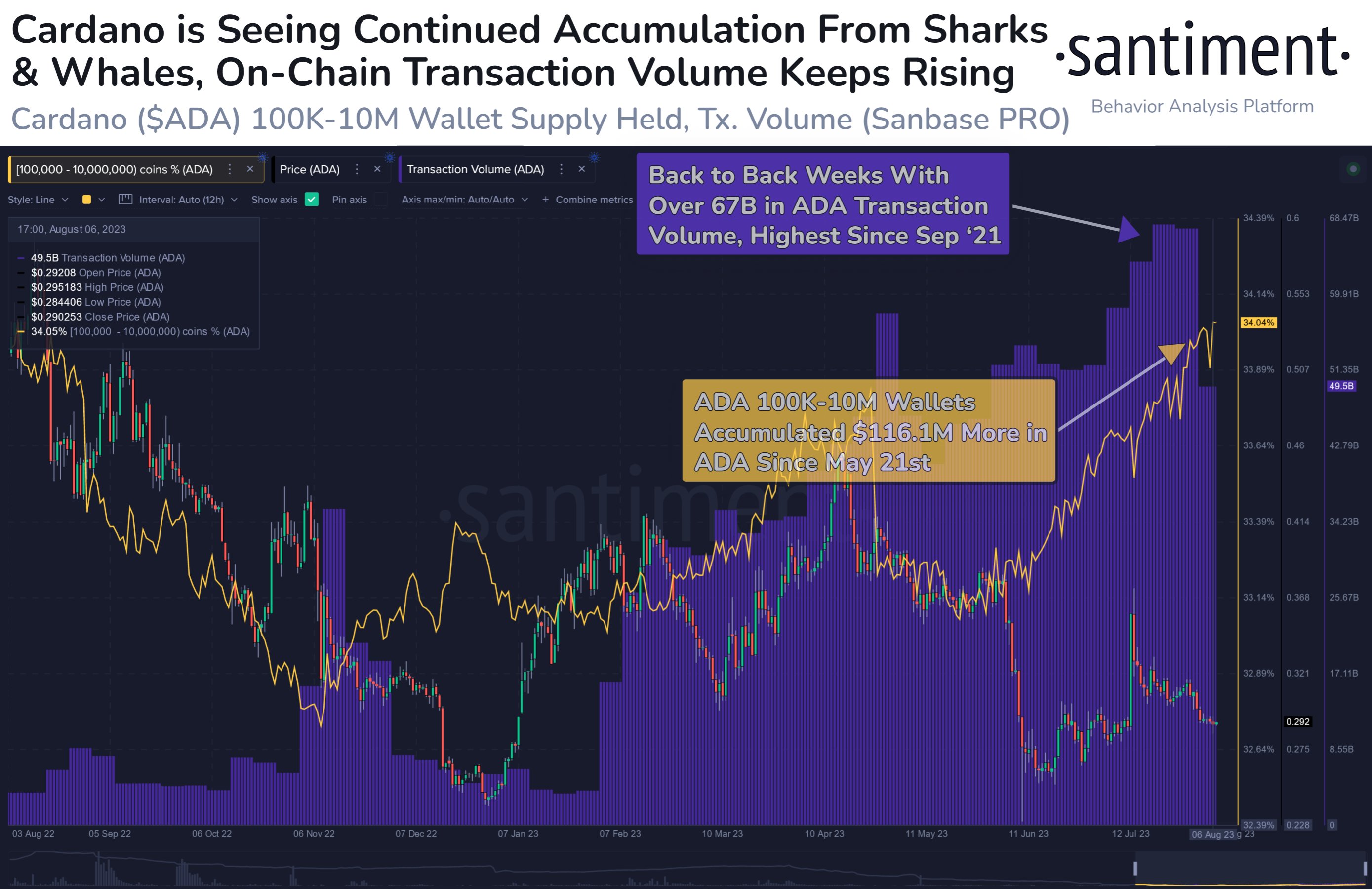

As Cardano sits simply above $0.29, whales and sharks holding between 100K-10M ADA have collected again to their highest stage since September, 2022. Moreover, on-chain transaction quantity has been rising practically each week for the previous 6 months.

This assertion is supported by information indicating ADA’s transaction quantity surged above a staggering 67 billion ADA in consecutive weeks, a peak not seen since September 2021. Such heightened community exercise is usually interpreted as a bullish signal, indicative of elevated consumer engagement and curiosity.

Moreover, ADA wallets holding between 100K-10M ADA now account for a big 34.04% of all circulating tokens, suggesting sturdy confidence amongst bigger buyers.

Additionally, Messari’s latest report on Cardano provides extra causes for optimism. The report delves deep into Cardano’s ecosystem, monetary developments, and community efficiency. One of many standout revelations is the surge in decentralized app (dapp) actions. For the third consecutive quarter, Cardano has seen a exceptional uptick in dapp transactions, boasting a 49.0% quarter-over-quarter improve in Q2, averaging 57,900 day by day transactions.

State of @Cardano Q2 2023

With a devoted neighborhood of customers and builders, Cardano has demonstrated endurance.

In Q2, common day by day dapp transactions have been up 49%, TVL up 10%, and 199% YTD.@redvelvetzip dives in. https://t.co/MNhyNJvIPq

— Messari (@MessariCrypto) August 4, 2023

Featured picture from Coinbase, chart from TradingView.com

[ad_2]

Source link