[ad_1]

Bitcoin (BTC), the main cryptocurrency, has defied expectations of a steep decline to sub-$20,000 ranges and has rebounded to the $26,000 mark, registering a 3.5% achieve over the previous 24 hours.

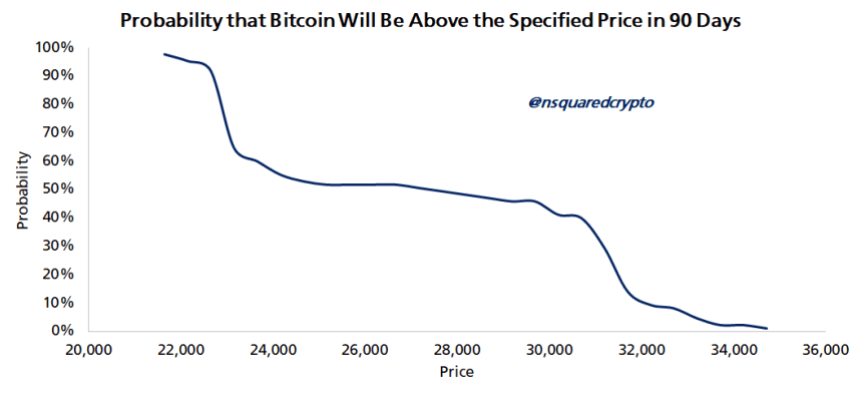

This resurgence in Bitcoin’s value coincides with the predictions made by Chartered Monetary Analyst Timothy Peterson, whose current social media publish outlined the chances of Bitcoin dropping to $22,600 or rallying to $31,200 inside the subsequent 90 days.

Bitcoin Value Evaluation, 8% Likelihood Of Drop To $22,600

Peterson’s evaluation signifies an 8% probability of Bitcoin experiencing a downward motion to $22,600, whereas a 71% likelihood of the cryptocurrency surging to $31,200.

Based on the chart above, Bitcoin’s value will doubtless enter a macro consolidation section over the subsequent 90 days. Throughout this era, the worth might fluctuate inside the vary of its key Shifting Averages (MAs).

Nonetheless, the essential issue for bullish traders is the low chance of a drop beneath $22,000. This enables them to regain management of the 50-day and 200-day MAs within the brief time period, at present positioned at $27,200 and $27,000, respectively.

The current restoration of Bitcoin to the $26,000 degree has alleviated considerations amongst market contributors who have been apprehensive a couple of potential downward spiral. The cryptocurrency’s means to bounce again has instilled renewed confidence amongst traders.

However, Bitcoin faces a collection of resistance ranges that might pose challenges. Within the rapid time period, resistance at $26,454 has quickly halted the cryptocurrency’s upward momentum.

As talked about earlier, Bitcoin misplaced its key MAs in August, leading to further obstacles on its journey again to $30,000. Nonetheless, if these resistance ranges are surpassed, there stays just one extra hurdle earlier than the cryptocurrency can surpass its annual excessive zone.

This remaining resistance stands at $29,800, which has traditionally confirmed to be a formidable barrier at any time when Bitcoin has aimed to realize new highs.

Imminent Remaining Decline Anticipated?

Because the market approaches the ultimate weeks of Q3 and edges nearer to the brand new 12 months, QCP Capital, an evaluation agency, has been intently monitoring the market utilizing two vital blueprints: the supermoon cycle and the Elliot Wave rely. In accordance to their evaluation, an imminent remaining decline is anticipated to shut the quarter at its lows.

The chart above illustrates the projected decline, aligning with QCP Capital’s blueprints. The agency believes that the crypto and macro occasions calendar additionally helps this view, with a focus of upcoming bearish occasions anticipated to transition to a impartial stance from mid-October onwards.

Notable future occasions embody tomorrow’s doubtless higher-than-expected CPI (Shopper Value Index) information and a extra hawkish-than-expected Federal Open Market Committee (FOMC) assembly subsequent week.

Moreover, asset gross sales of FTX tokens and the conclusion of the Mt. Gox proceedings over the subsequent month contribute to the bearish sentiment.

Though QCP Capital’s principle suggests a possible backside quickly after the supermoon early subsequent month, they anticipate the true backside to materialize in mid-late October when the adverse information cycle has run its course. They anticipate the market to stabilize throughout this time and doubtlessly reverse its downward pattern.

Regardless of the short-term challenges, QCP Capital stays bullish on the general outlook. They anticipate a constructive trajectory from mid-late October, extending into year-end and Q1 of the next 12 months.

BTC is at present buying and selling at $26,100, reflecting a 3.5% enhance over the previous 24 hours and a achieve of over 1.5% up to now seven days.

Featured picture from iStock, chart from TradingView.com

[ad_2]

Source link