[ad_1]

Solana (SOL) is poised to additional improve its decentralized finance (DeFi) ecosystem with the introduction of a brand new validator consumer. This thrilling improvement has garnered consideration from stakeholders and business specialists who imagine it may considerably bolster Solana’s place within the highly-stacked DeFi panorama.

As optimism runs excessive, Solana lovers eagerly anticipate the potential advantages that this progressive validator consumer might deliver, additional solidifying the platform’s future prospects.

Might this validator consumer be the catalyst that propels Solana’s DeFi ecosystem to new heights?

Enhanced Solana DeFi On The Horizon

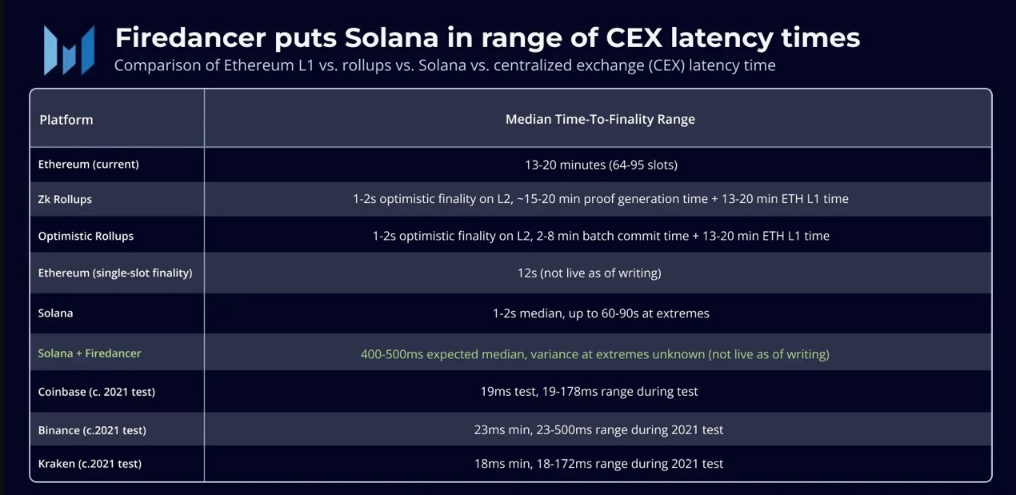

A current report on SOL value unveils an thrilling improvement on the planet of Solana’s DeFi ecosystem. Enter Firedancer, an impartial validator consumer developed by Bounce, which may revolutionize the DeFi panorama by enhancing essential features of the platform.

Firedancer’s major focus lies in decreasing latency occasions, successfully bridging the hole between decentralized exchanges and their centralized counterparts.

Supply: Messari

By successfully mitigating latency occasions, Firedancer has the potential to unlock quicker transaction processing throughout the Solana community. This transformative enhancement not solely guarantees a superior consumer expertise but additionally has the facility to draw a larger variety of individuals to the community.

The elevated effectivity and streamlined operations facilitated by Firedancer are anticipated to raise the scalability and value of decentralized functions constructed on Solana, paving the way in which for substantial progress and progress throughout the ecosystem.

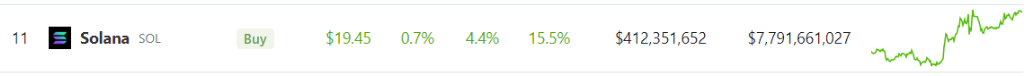

SOL market cap nearing the $8 billion stage. Chart: TradingView.com

Supply: Coingecko

As of writing, CoinGecko’s knowledge reveals SOL’s present value at $19.45, accompanied by a rise of 4.4% throughout the previous 24 hours. Moreover, the cryptocurrency has skilled a exceptional rise of 15.5% over the course of the previous seven days, reflecting the prevailing market sentiment and the potential affect of transformative improvements similar to Firedancer on the long run trajectory of Solana.

Solana’s Resilience Shines Amidst Market Volatility, Regulatory Challenges

Solana has emerged as one of many gainers in a blended early buying and selling session among the many prime 10 non-stablecoin cryptocurrencies by market capitalization. The rally comes as a breath of recent air after a collection of bearish indicators that surfaced final week, together with the closure of the Solana-based non-fungible token (NFT) protocol, Cardinal, citing “macroeconomic challenges.”

Hey Everybody, we now have some unlucky information to share 🙁

After quite a lot of reflection, we’ve determined to start the method of winding down our protocols. Let’s dive into it 🧵 ⬇️

— Cardinal (@cardinal_labs) June 28, 2023

Moreover, the Revolut neobank and crypto alternate reportedly introduced the delisting of Solana, Cardano, and Polygon for its US-based customers final Wednesday.

This information comes on the heels of the current lawsuit filed by the Securities and Trade Fee (SEC) towards main exchanges Coinbase and Binance.US, whereby Solana, Cardano, and Polygon had been named as tokens allegedly concerned within the unlawful issuance of economic securities.

Regardless of these regulatory hurdles and market setbacks, Solana has displayed resilience and managed to stay on a constructive trajectory amidst the volatility.

(This web site’s content material shouldn’t be construed as funding recommendation. Investing includes threat. Whenever you make investments, your capital is topic to threat).

Featured picture from Pexels

[ad_2]

Source link